Stacey Mullen

Stacey Mullen

May 21, 2024

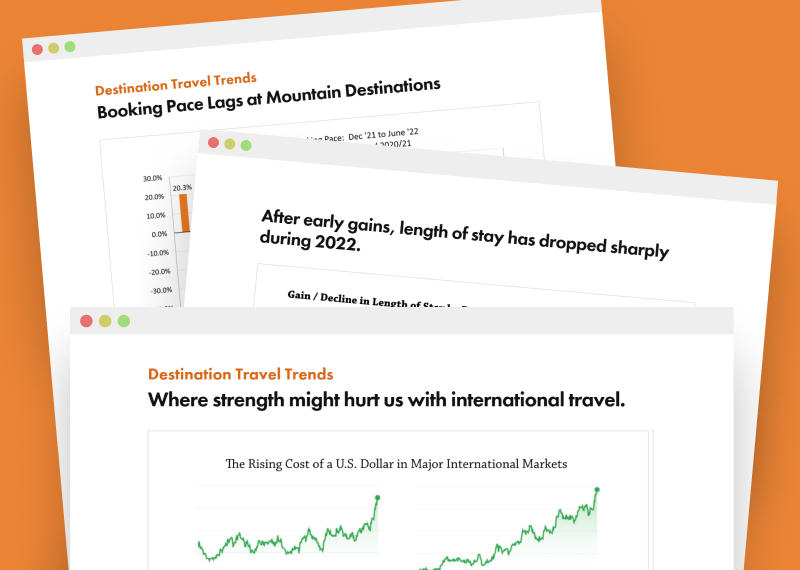

A famine-to-feast snowfall season coupled with stubbornly high inflation and interest rates led to declines in winter lodging occupancy across 17 western mountain resorts in seven states for the 2023-24 winter season. The results were released by DestiMetrics,* the Business Intelligence division of Inntopia, in their monthly Market Briefing with the winter season’s summary. Occupancy struggled throughout most of the winter so the somewhat lower figures were expected, but aggregated daily rates were up to help mitigate the declines in seasonal revenues as of April 30.

April disappoints

The Easter holiday landing in March this year posed a significant challenge for lodging properties to fill rooms during April, and mixed conditions on the slopes contributed to soft business at many resorts. The combination led to an 11 percent decline in occupancy for the month compared to last year at this time while the Average Daily Rate (ADR) dropped 5.2 percent. The decrease in both occupancy and rates delivered a 15.6 percent drop in revenue for the month.

Winter was down…but could have been worse

The winter got off to an undeniably slow start as limited snowfall and continued resistance to rising daily rates hampered the early season. Occupancy for the full winter from November through April was down a moderate 4.2 percent from last year’s near record-breaking numbers with declines in all six months—ranging from a scant 0.6 percent in March to the 11 percent drop in April. ADR for the season was up a modest 2.8 percent overall with only December and April showing a downturn in rates. The slight increase in rates allowed lodging properties to offset some, but not all of the impact of lower occupancy, and finish the season with a slight 1.6 percent decline in seasonal revenues.

“Forces beyond our control had a significant impact on this season and the industry had trouble recovering from the lack of early season snow. Plus, changes to holiday breaks in both December and April created another obstacle for lodging properties to navigate,” explained Tom Foley, senior vice president for Business Intelligence at Inntopia. “It could have been a really tough year but widespread and generous snowfall starting in mid-January helped considerably and allowed properties to maintain rate strength through almost the entire season. It is also worth remembering that last year was a very strong year in terms of performance, and it was always going to be a tough act to follow—even if the stars had aligned.”

All eyes on summer

As of April 30, occupancy for the full summer from May through October is up a scant 0.1 percent compared to last year at this time with increases in four of the six months—only June and October are currently posting declines. ADR for the summer months is up a moderate 4.3 percent with increases in all six months with notable increases of 10.4 percent in October and 7.9 percent in August. Those healthy rates are bolstering the essentially flat occupancy numbers and current revenue on-the-books for the full summer is up 4.4 percent compared to last year at this time.

“The upcoming summer is currently looking more typical after four years of dramatic swings starting with the sharp reductions in the early months of the pandemic, followed by the initial recovery, the surging rebound, and then the cooling off as pent-up demand for travel was sated,” observed Foley. “This year, on-the-books occupancy is showing almost no change from last year as of April 30 and that is somewhat concerning because last summer was really the start of rate pushback, which made it mediocre compared to the previous two. On the other hand, we’re finally seeing more stability in the variances of both rates and occupancy and that gives properties more flexibility to tweak rates or offer value-added promotions to adjust for shifting demand or economic conditions.”

Economic indicators downshift in April

The Dow Jones Industrial Average (DJIA) declined sharply in April by dropping five percent—more than 1,991 points, marking the first monthly decrease in the DJIA since October 2023, and the sharpest loss since September 2022. Rising labor costs, slumping consumer confidence, and ongoing inflation were cited as triggering the significant pullback.

Both the Consumer Confidence Index (CCI) and the Consumer Sentiment Index (CSI) also moved down during April. The CCI dropped 5.9 percent to finish the month at 97 points and is the third consecutive monthly decline in confidence. This is the first time it has been below 100 since October 2023 and the lowest it has been since July 2022. Consumers indicated concerns about inflation and job security for the decline with all income groups reporting a downturn in confidence. The CSI from the University of Michigan also dipped in April from 79.4 to 77.2 points with election anxiety playing a role as well as inflation. Older consumers reported more concern in both surveys, likely reflecting market angst as they have more investment in financial markets than their younger counterparts.

The National Unemployment Rate rose slightly to 3.9 percent as employers slowed down the pace of job growth to less than 200,000 for the first time since last November with just 175,000 new jobs added to payrolls during April.

The National Inflation Rate dipped to 3.4 percent year-over-year with prices in April up a softer-than-expected increase of 0.3 percent from March. Inflation also eased, lower than analysts anticipated, as smaller gains in services such as food services offset the continued higher costs of rentals and gasoline.

“After a slow start to the season, Mother Nature came through starting in January to transform mediocre conditions into very good to excellent at most western resorts. Along with consistently strong rates, the mountain lodging sector finished on a higher note than expected during the early season,” continued Foley. “Attention is now focused on summer where we are continuing to see softening demand but the primary concern now is how the economy performs and the impact that will have on consumers’ summer vacation planning. Right now, the Memorial Day weekend is floundering a bit but the 4th of July holiday week is pacing strongly and that momentum could carry through the crucial months of July and August if the economy cooperates,” he concluded.

Have a question? Just ask.

Tyler Maynard

SVP of Business Development

Ski / Golf / Destination Research

Schedule a Call with Tyler→

Doug Kellogg

Director of Business Development

Hospitality / Attractions

Schedule a Call with Doug→

If you're a current Inntopia customer, contact support directly for the quickest response →

Request Demo

A member of our team will get back to you ASAP to schedule a convenient time.