Katie Barnes

Katie Barnes

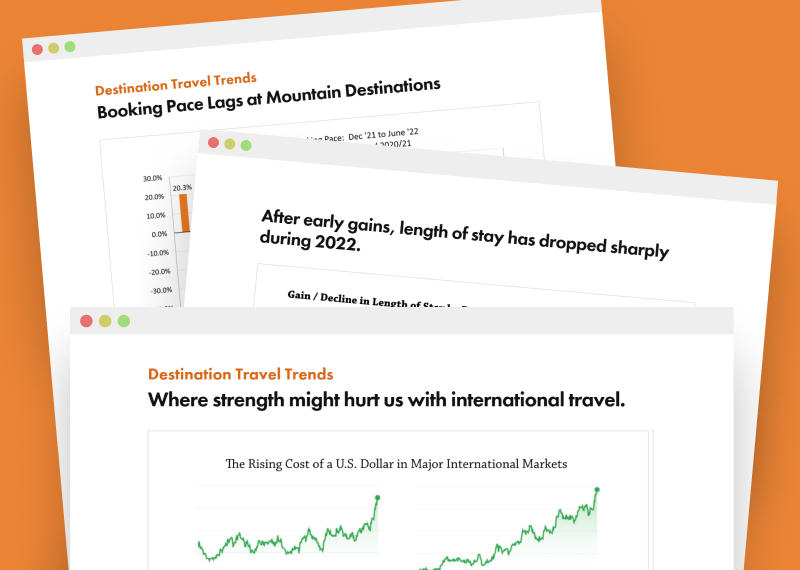

At the midpoint of the summer, occupancy and revenues at western mountain destinations continues to be dramatically lower than last summer. But the month of July clawed back some ground as pent-up demand combined with the attraction of outdoor mountain activities to capture visitors for overnight stays. The most recent results were released last week in the DestiMetrics* monthly Market Briefing by Inntopia, and includes data from six western states including Colorado, Utah, Nevada, California, Idaho, and Wyoming.

The month of July showed an appreciable recovery in bookings and the strongest booking month since February. As expected, the lead-time for advance bookings has become considerably shorter in recent months. Bookings made in July for arrival in July were up a dramatic 58.7 percent compared to bookings made in July 2019 for arrival in that month, while bookings for arrival in August are up 26.3 percent. Although bookings in July for arrival in the months of September through December did not keep up with last year’s booking pace, all six months except October saw an increase in actual occupancy rates—reflecting the pent-up demand. This shorter booking window signals that travelers are more confident reserving their overnight stays while current conditions are understood.

“The booking pace and ability to fill in vacancies are the two most crucial metrics that we are monitoring right now and July turned out to be an excellent month in both categories,” reported Tom Foley, senior vice president for Business Operations and Analytics for Inntopia. “Having evidence that visitors are now returning to destination travel is creating vital opportunities for lodging properties to better understand what conditions visitors are looking for in overnight travel, and how to best manage capacity issues as resorts and properties continue to make strategic operational decisions for the upcoming winter.”

Further evidence of improvements for participating lodging properties was the six percent increase in the Average Daily Rate (ADR) for July compared to July 2019 rates. Despite the uptick in rates, it was not enough to offset the steep declines in occupancy, and revenue was down 23.8 percent compared to last July’s figures. Although down, it still provides proof of recovery when compared to June’s revenues–down a staggering 62 percent.

Looking at the full summer season from May through October, occupancy is still down a dramatic 47.3 percent for the six-month period, but ADR for the period is up a strong 9.4 percent for the full summer with moderate gains in all months except May and June. Again, rate strength could not offset the low occupancy, and the seasonal summer revenue loss is 43.1 percent as of July 31.

Foley went on to clarify the unfolding situation by explaining that “pent-up demand creates an interesting dynamic where there is a high volume of bookings and high rates, but a relatively short booking window.” He compared the situation to an ocean wave that, after it crests, is expected to subside. Foley’s projection was that resolution of that wave would be in approximately the next 45 days.

“Because of this intense demand, western mountain resorts made some significant progress with bookings during July compared to last month, and considering the challenges presented by Covid-19, any positive news is notable,” continued Foley. “And while many regions of the country have experienced alarmingly high surges in Covid-19 cases, western mountain resorts were relatively clear of any major resurgence. That stabilization of new cases combined with strong demand and careful re-openings helped drive an increased booking pace and to fill-in some lodging capacity.”

Foley further emphasized how dramatic the situation has been, and will continue to be, by saying, “make no mistake, the industry scaled a cliff in July and the rest of a very steep and daunting mountain climb remains ahead as we forge forward into an uncertain winter.”

Economic measurements

For the fourth consecutive month, the Dow Jones Industrial Average (DJIA) increased and was up 2.8 percent compared to last month but remains two percent lower than last year at this time. After two months of moderate increases, the Consumer Confidence Index (CCI) once again lost traction and dropped 5.7 points and, as of July 31, is a dramatic 31.8 percent lower than it was in July 2019. The national Unemployment Rate dropped to 10.2 percent (from 11.1 percent in June) as employers exceeded analysts’ expectations and added 1.8 million jobs during the month.

“While Wall Street is showing considerable optimism about the eventual recovery from the pandemic, the DJIA increasingly fails to reflect the reality of conditions for the average consumer,” cautioned Foley. “Consumer confidence is unsteady, 30 million people remain unemployed, and government relief programs have expired and talks for extending financial support have stalled in Congress.”

Looking Ahead to Winter Months

Early data for the winter months is mirroring summer patterns as of July 31. Aggregated occupancy on-the-books for arrivals in November through January is down a sharp 38 percent compared to the same time last year with declines being reported in all three months. ADR for those months is down two percent compared to last winter at this time. November is showing a healthy increase in daily rates of 17.6 percent, but December and January are both declining.

“At the midpoint of summer, the situation is less frenzied than it was two months ago as properties have taken thoughtful steps toward sustainable re-openings and there have been modest increases in overnight visitors,” said Foley. “Strong rates and consistent short-lead bookings are encouraging for the near future, but the lack of long-lead reservations for the crucial winter season is troubling. However, lodging properties are facing the uncertainty of ski resort operational plans, return to school schedules, the trajectory of Covid-19 cases, the presidential election, declining consumer confidence, and shifts in key economic indicators in the months ahead. The headwinds the industry is facing are significant and that is before we even factor in what kind of snow year it will be,” he concluded.

*DestiMetrics, part of the Business Intelligence platform for Stowe-based Inntopia, tracks lodging performance in resort destinations. They compile forward-looking reservation data each month and provide individualized and aggregated results to subscribers at participating resorts. Data for western resorts is derived from a sample of approximately 290 property management companies in 18 mountain destination communities, representing approximately 30,000 rooms across Colorado, Utah, California, Nevada, Wyoming, and Idaho and may not reflect the entire mountain destination travel industry. Results may vary significantly among/between resorts and participating properties.

Have a question? Just ask.

Tyler Maynard

SVP of Business Development

Ski / Golf / Destination Research

Schedule a Call with Tyler→

Doug Kellogg

Director of Business Development

Hospitality / Attractions

Schedule a Call with Doug→

If you're a current Inntopia customer, contact support directly for the quickest response →

Request Demo

A member of our team will get back to you ASAP to schedule a convenient time.