Trends

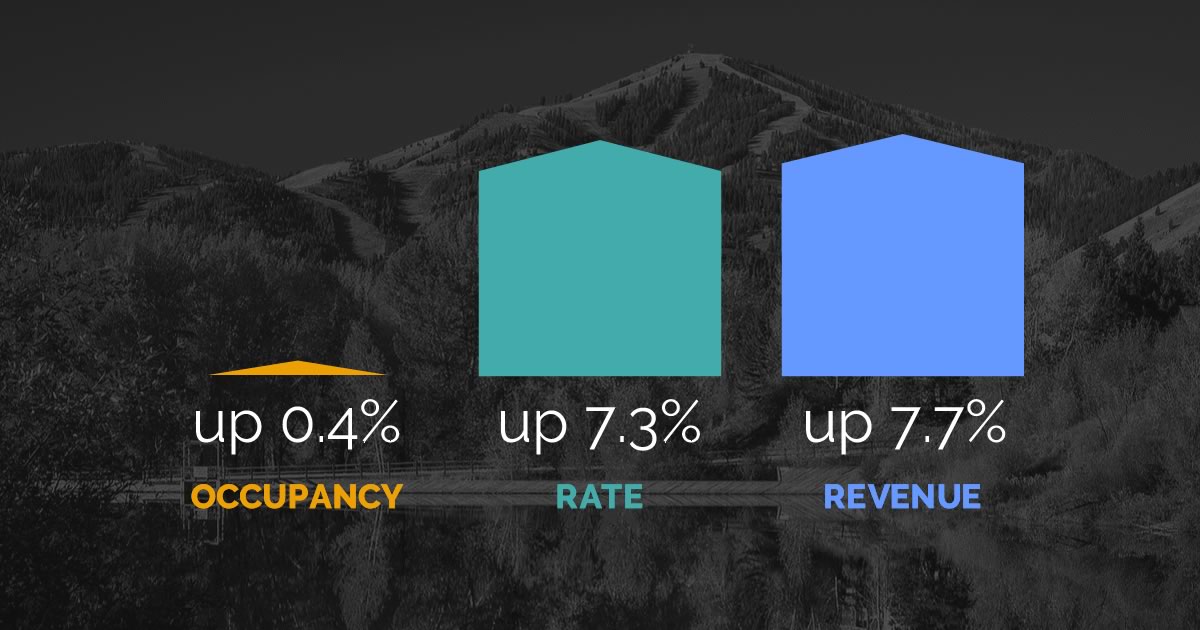

With half of the official summer season (May through October) completed and significant advanced reservation on the books, aggregated revenues at participating mountain resorts as of July 31 had already reached 90 percent of total revenues collected during the summer of 2016. This figure includes revenues that have already been collected for the first part of the summer or on-the-books for arrivals for the remaining three months of the summer (August through October). According to the most recently released data from Inntopia as part of the DestiMetrics Market Briefing, lodging occupancy for the full summer is up only a slight 0.4 percent. However, strong gains in the Average Daily Rate (ADR) at those same properties have boosted summer revenues 7.7 percent compared to the same time last year. Actual occupancy for the month of July was down 1.7 percent but also enjoyed a 7.7 percent gain in revenue.

“Revenue growth in the previous five summers has been due to a combination of steady increases in both occupancy and ADR,” explained Ralf Garrison, advisor to Inntopia. “But this summer is markedly different; occupancy figures have remained essentially flat while revenue figures continue to climb.”

Projections based on the data provided by 20 mountain destinations in eight states suggest that the trend will continue through the remainder of summer and into the early winter. Bookings made in the month of July for August arrivals were down a slight 1.9 percent but September is up 3.3 percent, October is up an enormous 71.1 percent, November is up 27.1 percent and December is up 0.4 percent compared to the same time last year. The trend is consistent with the past few summers as September and October continue to significantly outperform the other summer months in a year-over-year comparison.

A strong economy gets a large portion of the credit for the continued upward trend in revenues. The Dow Jones Industrial Average soared up 541 points in July for its fourth consecutive monthly gain and finishing 3,450 points higher than July of 2016. The Consumer Confidence Index (CCI) also bounced up 3.2 percent after three consecutive months of decline, and pushed the Index over the 120-point mark for only the second time since December 2000. The CCI now sits 25.2 percent above where it was in July 2016. And on the employment front, employers exceeded expectations by adding 209,000 new jobs and helped bring the Unemployment Rate down to 4.3 percent—down ten basis points from June.

“Wall Street continues to be bolstered by strong job creation and consumer confidence, despite a hum of concern about government policy on health care initiatives and tax reform,” observed Tom Foley, vice president of Business Intelligence for Inntopia. “Consumers expectations for the short-term outlook rose last month and suggests that they expect current conditions to improve through the remainder of the calendar year. And even though wages and earnings continue to remain mostly stagnant, mountain visitors this summer have shown remarkable tolerance for steadily increasing rates,” he continued.

Regional differences between the Far West and Rocky Mountain destinations were also noted. Destinations in the Far West states of California, Nevada, and Oregon have experienced an aggregated two percent decline in occupancy while participating destinations in the Rocky Mountain states of Colorado, Utah, Wyoming, Montana, and Idaho have ticked up 1.1 percent compared to last summer. The ADR for the Far West has risen 4.9 percent in the last year while the Rockies are up 8.3 percent from last summer’s all time revenue record.

“This pattern of building revenue almost entirely on rate gain is a continuation of the pattern that emerged last winter, but it does raise questions about the cause of the change,” noted Foley. “It is still unclear whether it is pressure on professionally managed inventory from rent-by-owner options like VRBO or Airbnb or simply market tolerance for higher rates that are impacting bookings,” he continued. “Conversely, the higher rates may be a result of the higher occupancy. Regardless of the reason, it is clear that consumers are behaving differently when it comes to purchasing their lodging in mountain communities and once again, lodging properties and mountain towns will need to understand and adapt to the new reality,” he concluded.