Destination Travel Trends

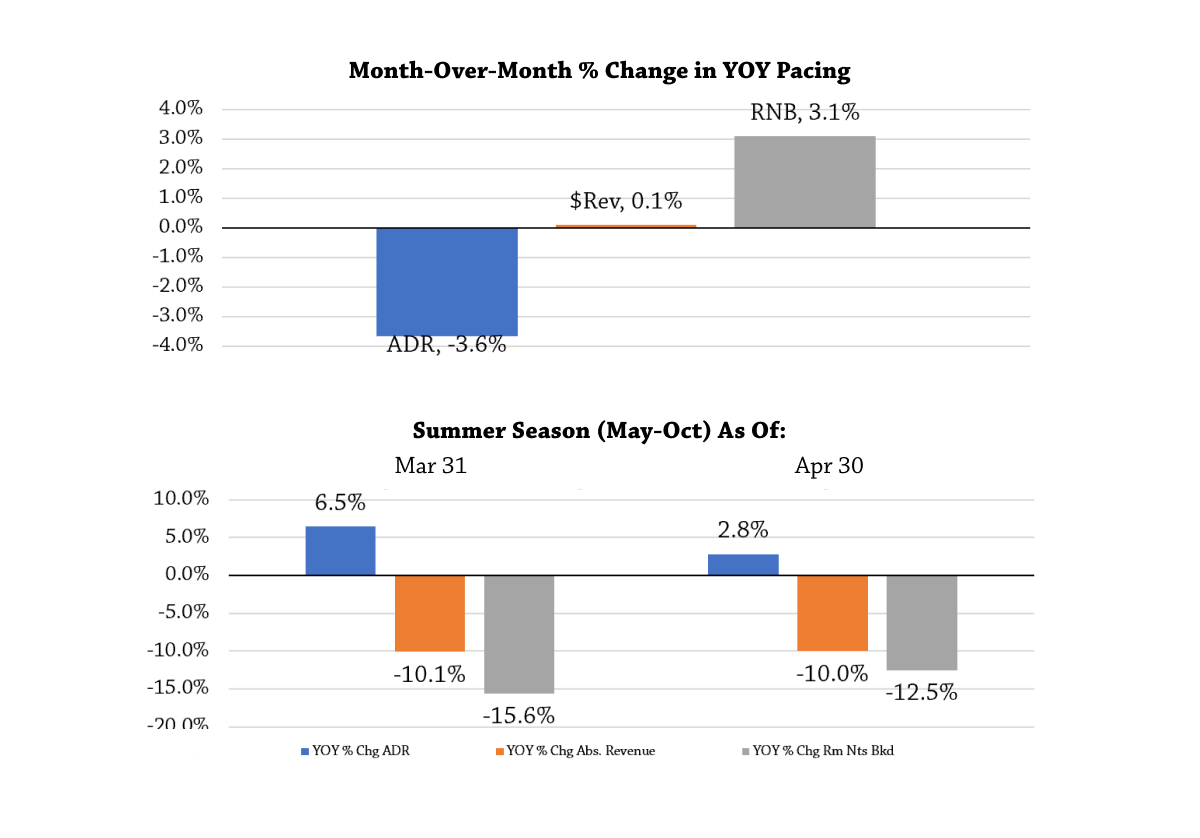

The Summer Season Setup as of Apr 30, 2023: average daily rates (“ADR”) are up 2.8% year-over-year (YOY), room nights booked (“RNB”) are down -12.5% YOY, and revenue is down -10.1% YOY.

Lodging providers at mountain towns have softened YOY rate for summer arrivals by -3.6 percentage points since Mar 31 to drive booking volume. Consumers have responded, with YOY RNB improving by 3.1 percentage points since. But because these changes nearly offset each other, revenue is almost unchanged over the same time, up just 0.1 percentage points since Mar 31.

Lodging suppliers must find a way to shift revenue wins from rate-driven to volume driven by driving higher demand with only modest wiggle room to spare on ADR. That process started over the last month as YOY ADR softened from 6.5% in March to 2.8% as of Apr 30. But while 2.8% is modest by recent standards, at $400/night it’s more than 32% higher than 2 years ago and 40% higher than 2019 (2.5x more than inflation over the same period). Record rates during tough economic conditions have resulted in softness and shorter stays since Jan ’22, and summer RNB is down -12.5%. Since revenue is a mix of Nights Booked and ADR, the negative RNB is pulling down revenue, -10.0%.

The challenge? Triggering a greater gain in RNB than decline in ADR. But at $400/night it’s hard to get ADR to a palatable level in a tight consumer economy without turning the 2.8% ADR gain negative, making the calculus even tougher. Suppliers will have to rebuild demand with a small ADR scalpel when they need a hammer, so value-add propositions will be a valuable tool to complement that rate scalpel.