Trends

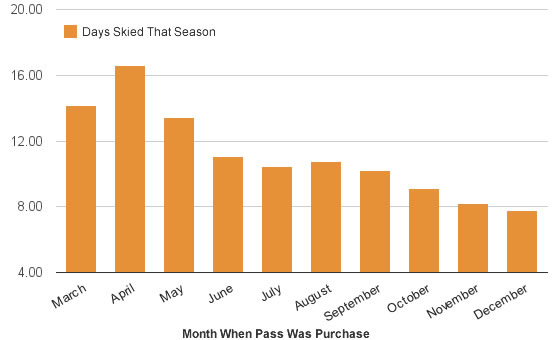

Two weeks ago we found that skiers who bought their season pass before summer were much more likely to renew the follow season than those who didn’t. One of our theories was simply that spreading out pass sales from March – December acted as a sort of filter that highlighted the most passionate, core skiers on your mountain. This week, we’re following up on that data by comparing when someone buys their pass to how many days they ski that season.

The Goods

For this analysis, we took data across two seasons from a half-dozen resorts that run spring pass sales. Like the analysis we mentioned above, we again grouped skiers by the month in which they bought their season pass. The difference being that instead of looking at renewal rate, we found the average number of days each group of passholders got on the mountain that season.

The trend is pretty easy to see. Skiers who bought their passes in April racked up more than twice as many days on the mountain as those who purchased in November. While March and May were below April in terms of days skied, they were still well above any other month.

What This Means

More than anything, this seems to confirm our theory that pass sales that start early tend to separate the casual from the core passholders at a resort. The skiers who buy in April ski more and, perhaps because of that, are more likely to renew the following season. More than early revenues, spring pass sales are teaching you some valuable lessons about your passholders.