Stacey Mullen

Stacey Mullen

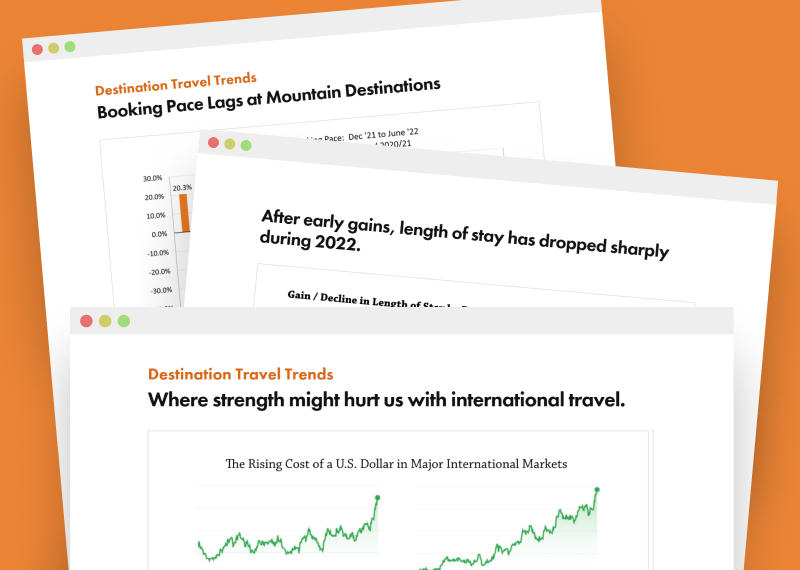

The booking pace for lodging at 17 mountain destinations in seven western states improved slightly during the month of June but occupancy is still down compared to both last summer and the pre-pandemic summer of 2019. That slump in occupancy for the months of May through August was reported yesterday by DestiMetrics,* the Business Intelligence division of Inntopia on data collected through June 30. Economic variables are having considerable influence as high inflation, rising interest rates, and declining financial markets are dampening consumer’s appetite for travel during the peak summer months—particularly July and August. Travelers seeking affordability are shifting their bookings to the shoulder season months of September and October when daily rates are typically lower than the summer peak. Despite the declining occupancy, room rates remain strong and aggregated revenue for the summer season is likely to set an all-time high record.

Summer season compared to previous three years

On-the-books occupancy for the six months from May through October is down nine percent compared to last year at this time and is currently down in all six months with July and August posting the most notable drops—12.3 and 17.7 percent respectively. Average Daily Rate (ADR) is up 6.9 percent with increases in all six months but with the decrease in occupancy, aggregated revenue is down 2.8 percent compared to last year.

As expected, compared to the uncertainty of two years ago at this time when pandemic restrictions were crippling travel, summer occupancy is up 121.3 percent compared to the summer of 2020 with ADR up 32.7 percent to deliver revenues that are up a stunning 194.2 percent.

When comparing this summer to Summer 2019 before the pandemic threw all comparisons out of whack, overall occupancy is down 3.5 percent with declines in May through August but with on-the-books increases for September and October. Daily rates are up 38.7 percent with gains in all six months and those very strong rates are offsetting occupancy losses to deliver an impressive 34 percent gain in summer revenues.

“Booking pace in June was ‘less bad’ than in May and when coupled with still very strong daily rates, is helping to mitigate occupancy declines compared to both last year and the pre-pandemic summer of 2019,” explained Tom Foley, senior vice president of Business Intelligence for Inntopia. “In a year-over-year comparison, all six months are down over that extraordinary rebound from the height of the pandemic but we’ve been anticipating that for a full year. A bright spot is that compared to the Summer 2019, there are some appreciable upticks for the months of September and October, an indicator of consumers avoiding the higher-priced months of mid-summer and focusing on value.”

Key observations

*Bookings made in June 2022 compared to June 2021 for arrivals in June through November are down 27.6 percent which is an improvement from the 40.1 percent decline recorded as of May 31 but still very sharp. This is the fifth consecutive month of decreased bookings.

*Occupancy is unlikely to match the summer of 2021 with the steep declines in July and August, but occupancy for September and October is expected to be strong in a year-over year comparison. Those lower-priced months will help offset occupancy losses in the peak months, but not revenue.

*Consumers are pushing back against high rates which is clearly illustrated by long-term declines in booking pace. However, lodging properties have been maintaining the historically high ADR and are likely to achieve bottom line revenue goals with fewer guests. With less staff to manage full capacity, this tactic may work in the short-term but economic pressures may exert more pressure on ADR in the upcoming months.

Economic indicators

The Dow Jones Industrial Average (DJIA) declined 5.94 percent to post its lowest monthly close in 16 months—since February 2021. The Index is currently 10.1 percent lower than it was in June 2021 as Wall Street continues to react negatively to declining consumer confidence and as higher inflation is fueling fears of a recession in the next 18 months.

The Consumer Confidence Index (CCI) dropped a sharp 7.2 percent in June marking the first time the CCI has dipped below 100 points since February 2021 as consumers reacted to rising costs for nearly everything. Intentions to travel in the coming months declined as consumers are redirecting discretionary dollars to food, gas, and household items. This slowdown in travel intentions has been evident in the DestiMetrics booking data since last January.

For the fourth consecutive month, the Unemployment Rate was unchanged at 3.6 percent in June as employers added an unexpectedly strong 378,000 new jobs during the month—approximately 100,000 more than projected. And while the private sector has exceeded pre-pandemic payrolls, the Leisure and Hospitality industry remains dramatically lower than February 2020—down 1.3 million workers.

“The strong job growth along with high inflation will likely prompt the Federal Reserve to be more aggressive with interest rates in an attempt to control inflation and that will make managing debt more expensive for consumers,” observed Foley. “And that added expense will put more pressure on discretionary purchases—including travel.”

The National Inflation Rate increased once again in June with prices up 9.1 percent compared to this same time last year and is the second consecutive monthly increase and the ninth in the last ten months. The price of food was up 10.4 percent while the price of energy was up a staggering 41.6 percent led by a nearly 60 percent increase in gasoline.

“Declining room nights aren’t a reason to reduce room rates at this point because there are enough bookings to put on-the-books revenue for the full summer above $442 million and very close to the June 30 record set last year,” added Foley. “That said, with current economic conditions and the likelihood of a recession approaching, lodging properties may be forced to lower rates in the coming months. But mountain travel has weathered economic downturns before and performed better than other economic segments in the past so we’re not being too pessimistic yet,” he concluded.

Have a question? Just ask.

Tyler Maynard

SVP of Business Development

Ski / Golf / Destination Research

Schedule a Call with Tyler→

Doug Kellogg

Director of Business Development

Hospitality / Attractions

Schedule a Call with Doug→

If you're a current Inntopia customer, contact support directly for the quickest response →

Request Demo

A member of our team will get back to you ASAP to schedule a convenient time.