Trends

The trifecta that dampened lodging occupancy during November persisted into December when the stakes, and expectations, are higher. Consumer optimism couldn’t offset the challenges presented by meager snowfall, school holidays that started nearly a week later than usual, and ongoing resistance to near historically high daily rates at western mountain destinations. In the most recent monthly Market Briefing released by DestiMetrics,* the Business Intelligence division of Inntopia, December marked the second consecutive month in more than two years that aggregated revenues declined for the 17 participating destinations across seven western states.

December disappoints

In a year-over-year comparison to last December, occupancy dipped 2.7 percent and the Average Daily Rate (ADR) slipped 1.1 percent for revenues that were 3.8 percent lower than one year ago. Looking back further, occupancy during the pre-pandemic December of 2019 that was comparable to this year—is up 0.2 percent. The more striking contrast is daily rates that are up a dramatic 29.8 percent compared to four years ago and are providing properties with a 30.1 percent increase in aggregated revenues compared to December 2019—before the pandemic and its aftermath dramatically skewed performance and results in 2021 and 2022.

Winter season currently in slow skid

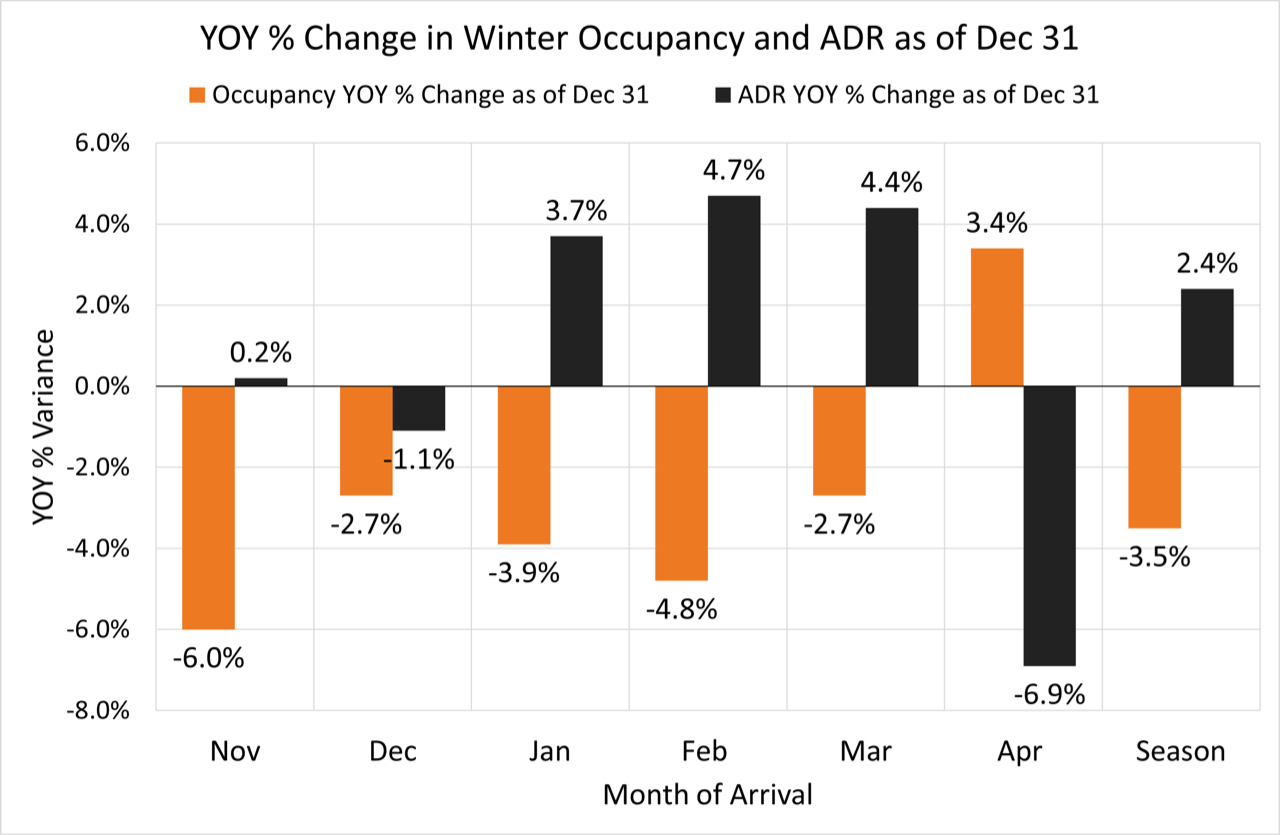

As of Dec. 31, in-the-bank and on-the-books occupancy for the full winter season from November through April is down 3.5 percent compared to last year at this time with declines in every month but April, which is up 3.4 percent. ADR is up a modest 2.4 percent with modest gains in four of the months—only December and April are posting declines. In contrast, February rates are up 4.7 percent over last year and March is coming in with its single highest aggregated average daily rate ever—more than $726/night. Even with the uptick in daily rates, winter revenues are currently down 1.2 percent over last year.

Despite some snow challenges, the current winter season compares favorably to the winter of 2019-20 with overall seasonal occupancy up 1.1 percent, daily rates up an impressive 40.7 percent with very strong gains in all months, and revenues up 42.4 percent.

“The holiday period, especially between Christmas and New Year’s, typically captures the highest rates of the year and strong occupancy can have a big impact on the bottom line at the end of the season,” explained Tom Foley, senior vice president of Business Intelligence for Inntopia. “But holidays alone can only drive so much business, and when you have mediocre snow and substantial shifts in the holiday school schedule, it becomes pretty tough to meet expectations.” He went on to clarify by saying, “that said, when you compare this season so far to the last pre-pandemic winter four years ago and a good comparison, this season is actually looking pretty good considering the challenges. You have to keep some perspective when looking at the current year-over-year data.”

Thumbs up on economic headlines

Once again during December, the Dow Jones Industrial Average (DJIA) rose sharply, adding 6.4 percent during the month on top of the impressive 7.6 percent gain in November. The DJIA closed at an all-time high of 37,710.1 points on Dec. 28 and boosted the Index more than 4,760 points higher than it was at the end of October–and 13.7 percent higher than it was one year ago at this time. Investors were buoyed by further easing of inflation, indications that interest rates will start going down in 2024, and holiday spending that exceeded expectations and helped bolster the end-of-year momentum.

“Strong financial markets can have a significant impact on consumer purchasing behavior as savings and investments grow, but so far that ‘feeling flush’ sentiment has not showed up at mountain resorts where daily rates continue to appear as a pain-point for bookings,” observed Foley.

Reflecting some of this financial optimism, both the Conference Board’s Consumer Confidence Index (CCI) and the Consumer Sentiment Index (CSI) from the University of Michigan were up in December as consumers reported more confidence in both short- and long-term prospects for themselves and the economy. The CCI was up for the second consecutive month by adding a strong 9.6 percent over November and settling just 3.3 points lower than its 24-month high in July 2023. Improvements were seen across all age groups and income levels but the largest increase was in households between the ages of 35 and 54 with income levels above $125,000. The CSI enjoyed an even sharper increase, up 13.7 percent to also arrive at a position just slightly below its 24-month high back in July. All age and income levels responded favorably on all major CSI index components—a result that has only occurred 10 percent of the time since its inception in 1978. The optimistic responses were deemed a direct response to lowering inflation and the prospect of declining interest rates.

The National Unemployment Rate was unchanged at 3.7 percent during December as employers, once again, exceeded expectations by adding a strong 216,000 new jobs. However, it is not clear whether those positions were for holiday hiring or will convert to full-time positions. And for the eighth consecutive month, wages rose—up 0.4 percent and outpacing the national inflation rate and contributing to the surge in consumer sentiment.

The only downshift in economic news was the National Inflation Rate which rose from 3.1 percent in November to 3.4 percent in December with consumer prices also going up a seasonally adjusted 0.3 percent. Increases in electricity and car insurance were cited for the rise while airfares edged up one percent after large declines in mid-2023.

Keeping an eye on

*Snowfall: Dry conditions dominated the weather patterns across much of the western US during December leaving only modest snowfall reports throughout the month. Snowmaking significantly enhanced conditions at most resorts but the month lacked the buzz and enthusiasm that follows big snowstorms–making the short-lead bookings needed to fill vacant rooms considerably more difficult.

*Winter occupancy: The trend of weakening occupancy continued into December compared to last year—dropping from a three percent seasonal deficit last month to a 3.5 percent deficit as of Dec. 31. The month of December took the biggest hit, slipping from a two percent deficit to a 2.7 percent deficit with the losses primarily in the second half, and most expensive, weeks of the month. “Declines in the holiday period when rates are 5-20 percent higher than any other time of the year can have a substantial impact on revenues for the month—and the season,” reported Foley

*School Breaks: Although properties were aware of the widespread late start to holiday breaks and the likely impact on early holiday-period bookings, the extended school break through the first week of January was expected to pick up some of that pre-Christmas decline. But as of Dec. 31, that projection had changed and January occupancy fell off sharply during the past few weeks with occupancy barely even, and in some cases down, for that period. Overall, total occupancy for the week of Dec. 16-21 finished down an aggregated 8.1 percent while the first week of January which was hoped to offset that deficit, was up only a slight one percent.

*Average Daily Rate (ADR): Year-over-year ADR for the full winter eked out a slight gain during December, up from 2.3 percent as of Nov. 30 to up 2.4 percent as of Dec. 31. “The impact of high daily rates on bookings and occupancy has been apparent since last February,” noted Foley. “We have seen a clear correlation between gains in rate leading to lower occupancy and vice-versa,” he continued. “It is particularly notable right now in March through January which is showing marked increases in ADR but declines in occupancy. In contrast, April rates are down sharply and there has been a significant increase in bookings as consumers respond to that lower price incentive.”

Different lodging categories; different results

Price sensitivity continued to play a role across the three categories—economy with ADR up to $400, mid-range from $401 to $850, and luxury at $851 and above. Last month, mid-range properties were managing positive revenues compared to last year but as of Dec. 31, all three categories are now posting revenues that are either flat or down slightly. Interestingly, economy properties slipped the most as their asking rates back in November softened but didn’t attract enough response, and their occupancy dropped 6.9 percent. Mid-range properties also lowered rates slightly and experienced a dip in occupancy, now down 0.7 percent—after being up one month ago. Luxury properties posted positive ADR in November but also dropped rates during December and that improved their December occupancy—taking it from down 3.5 percent one month ago to down only one percent as of Dec. 31.

“Although there is still plenty of season left to go, December didn’t perform as well as hoped as it was hampered by the ‘imperfect’ storm of unfortunate school break timing, meager snowfall, persistently high daily rates, and consumer caution,” acknowledged Foley. “But the economic indicators are more upbeat than they have been for months, inflation is receding, and best of all, the magic wand of Mother Nature has delivered abundant snowfall at many western mountain resorts in the past week. That combination can easily change this season’s narrative in a very short time,” he concluded.