Tom Foley

Tom Foley

As the world has grappled for the past two years with the COVID-19 pandemic, measuring the path and speed of recovery is complicated and the mountain travel industry is no exception. The most recent results from DestiMetrics,* the Business Intelligence division of Inntopia, provides multi-year comparisons in their Monthly Market Briefing to data from last year, two years ago, and three years ago when mountain lodging set an all-time record for both occupancy and rate in the pre-pandemic 2018-19 season. By comparing to multiple years, the impact of the pandemic on travel-ability, pricing, and consumer demand becomes clearer. The data is aggregated from approximately 28,000 lodging units in 17 western mountain destinations.

This February

Compared to one year ago at this time—February 2021: Occupancy was up 27.5 percent and the Average Daily Rate (ADR) was up 41.2 percent. The combination provided an 80 percent gain in revenue for the month. Reason for stunning contrast? Vaccines were becoming more widely available one year ago at this time.

Compared to two years ago at this time—February 2020: Occupancy was up four percent and the ADR was up 29.5 percent for a 34.7 percent gain in revenue. COVID-19 was beginning to be more widely reported.

Compared to three years ago at this time—February 2019: Occupancy was up 3.7 percent, ADR was up 34.7 percent to generate an impressive 39.6 percent gain in revenue compared to this month in the record breaking, pre-pandemic season. Most mountain visitors clearly demonstrating little to no resistance to rising rates as demand for mountain lodging remains strong.

Four very different seasons

The winter season of 2018-19 was record-breaking. The following winter of 2019-20 was on track to beat that record until abruptly truncated mid-March due to the pandemic. Resorts and mountain communities reacted and adapted for the 2020-21 season with safety procedures and enticing rates while vaccinations starting in late January and picking up pace in February brought increasing confidence for overnight travel. And now, nearing the end of the 2021-22 season and despite a setback due to a surge in cases of the Omicron variant in January, mountain destinations are showing a robust return to strong occupancy and remarkably high rates.

For the full winter season from November through April, the comparisons show dramatic, although not unexpected, contrasts from year to year.

Compared to last year as of Feb. 28: Occupancy, both actual and on-the-books for the remainder of the season, is up a strong 32.8 percent compared to last winter (2020-2021) with gains in all six months. ADR is up 35.3 percent and when combined with strong occupancy, is yielding a whopping 79.7 percent increase in winter season revenue.

Compared to two years ago as of Feb. 28: Occupancy is up 6.5 percent compared to the season of 2019-2020 at this time (just prior to the onset of the pandemic). ADR is up 28.8 percent to yield an impressive 37.1 percent increase in revenue.

Compared to three years ago as of Feb. 28: Occupancy is currently up 4.2 percent compared to the record-holding season of 2018-2019 but with ADR up a remarkable 32.4 percent than that “best-ever” season, lodging properties are seeing a 38 percent gain in seasonal revenues with gains in all six months.

“Occupancy, rates, and revenue were all up not only when compared to last year but the pre-pandemic season two years ago and the previous high benchmark posted three years ago during the 2018-19 season,” emphasized Tom Foley, senior vice president, Business Intelligence at Inntopia. “Most notably, daily rates continue to set new records on a monthly basis as the season progresses, despite inflation at a 40-year high and gains in lodging rates hovering 300 to 400 percent higher than the national inflation rate.”

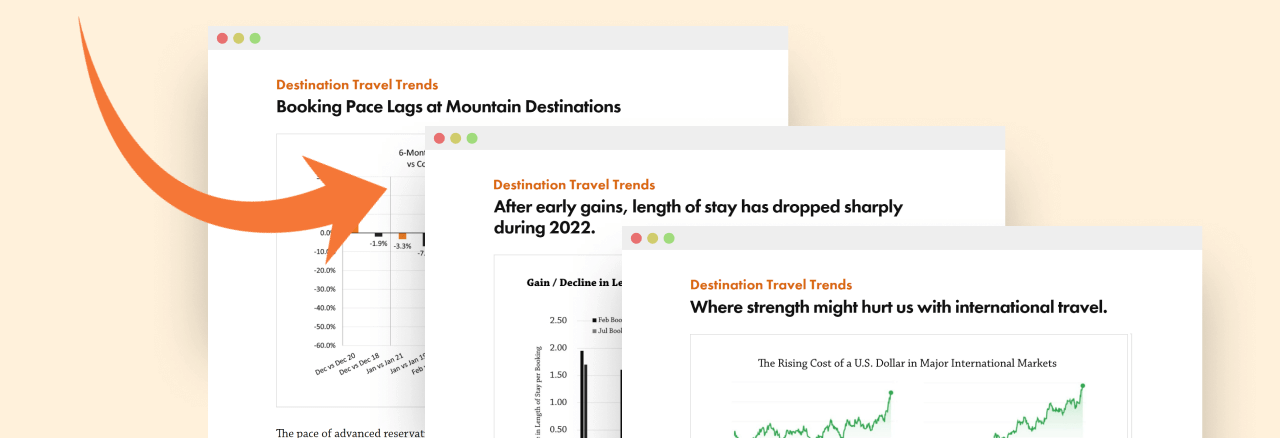

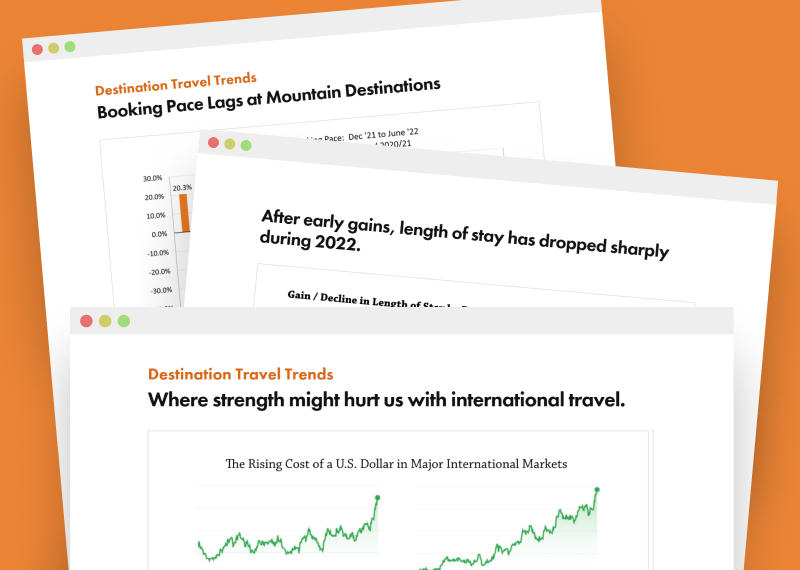

February booking pace

As new COVID-19 cases decrease and various restrictions and mandates are eased or eliminated, booking pace during the month of February is settling into more typical patterns. Bookings made in February for arrivals in the months of February through July are currently comparing to previous years as described below:

- Compared to one year ago: absolute occupancy booked in February is up 4.8 percent for those six months but a decrease in booking pace (bookings made this year versus last year) for February and March arrivals has led to an aggregated 38.1 percent decline in the booking pace for those six months

- Compared to two years ago: at 4.8 percent, absolute occupancy booked in February was just slightly lower than the 4.9 percent booked in February two years ago, resulting in a slight 2.4 percent decline in booking pace

- Compared to three years ago: the 4.8 percent absolute occupancy booked in February this was considerably lower than the 6.1 percent gain made three years ago, resulting in a 17.8 percent decline in booking pace compared to February 2019

“The booking pace during February was similar to both December and January patterns when compared to the previous two years but for very different reasons,” explained Foley. Bookings made in February this year for arrivals in that month were relatively soft as consumers considered snow quality, lingering Omicron concerns, inflation, and global issues. Plus, due to the strength of bookings at the start of the season, there just wasn’t as much capacity. In contrast, the arrival of widespread vaccine access last year at this time boosted optimism and bookings for arrivals in February 2021 and the remainder of the 2020-21 season and that booking surge last year makes this year’s bookings look weaker, although they are anything but,” he clarified.

Updated look at summer

As the winter season starts winding down, consumer interest for the upcoming summer from May through October is picking up and those six months are extending the well-established strength and growth of the past months. As of Feb. 28, aggregated occupancy for the six months from May through October compared to last year at this time is up 37.5 percent with ADR up 6.2 percent for a 46.5 percent gain in on-the-books summer revenue.

Looking back to two years ago at this time, occupancy is up a slight 3.6 percent with gains in every month but May with daily rates up 32.2 percent for an aggregated 36.9 percent increase in lodging revenues. And when looking back to three years ago at this time? Occupancy is up only a slight 2.5 percent but with daily rates up 37.8 percent, properties are looking at on-the-books revenue that is up an exceptional 41.2 percent over the summer of 2019.

Economic indicators

Once again, the Dow Jones Industrial Average (DJIA) lost considerable ground during February and followed January’s steep decline to close down 3.5 percent or 1,239.3 points lower than the January close. Moderate gains early in the month were erased with the ongoing buildup of Russian troops on the Ukraine border and the prospect of a war in Europe as the index plunged dramatically after the invasion began on Feb. 24. Other factors adding volatility to markets are the rising price of oil, continued inflation, uncertainty about the Federal Reserve’s plan to gradually raise interest rates, and domestic consequences from the sanctions against Russia. Despite the turbulence, the DJIA is currently 9.6 percent higher than at the same time last year.

Reflecting domestic inflation and global turmoil, the Consumer Confidence Index (CCI) declined for the second consecutive month—0.6 percent to 110.5 points. Although consumer concern only dipped slightly, short-term growth prospects weakened as the numbers of consumers planning to purchase a home, cars, or new appliances during the next six months declined.

Employers added a surprising 678,000 new jobs during February to drive the national Unemployment Rate down from four percent to 3.8 percent. Aided by the higher-than-expected job creation—278,00 more than projected—the December and January numbers were revised upward an additional 92,000 to further enhance the strong employment report. And once again, the Leisure and Hospitality sector led the way with 179,00 new positions—although the sector is still short 1.1 million positions and overall, there are 2.1 million fewer jobs than before the pandemic.

Still watching

Room Nights Available – the total number of professionally managed room nights available for short-term rental remains down compared to this same time two years and a deeper decline than just one month ago, though the rate of inventory attrition is slowing.

Room Nights Booked – the decrease in nightly rooms available has slightly skewed the occupancy figures and the higher occupancy figures in February compared to two years ago since it is almost entirely due to a 4.5 percent decline in available rooms rather than an increase in room nights booked.

Snow, always snow – the volume of snow and quality of conditions was mixed across many regions as certain resorts received moderate snowfall and maintained depths while other regions remained dry. Even the Rockies had uneven results as northern regions received considerably more snow than southern destinations. Overall, the slopes experienced slightly declining snow depth and quality.

“Booking pace lagged a bit in February but that has more to do with booking surges last year at this time as vaccines were rolled out. We’re not seeing any notable declines in either occupancy, rates, or revenue for the remainder of the winter season—which are all continuing their sustained growth,” summarized Foley. “But even as all three categories are currently ahead of the past three years, including the record-setting season of 2018-19, there are some formidable headwinds blowing our way. Consumer anxiety about two years of constant crises–according to a Bloomberg survey, ongoing and rising inflation, and concerns about the current state of world affairs. All of these issues are compelling properties to remain nimble in their operations as they determine how to best serve their guests,” he continued. “That said, time and again, the mountain travel industry has proved more resilient than most and their visitors continue to absorb rising rates and uneven services with little to no resistance,” he concluded.

Have a question? Just ask.

Tyler Maynard

SVP of Business Development

Ski / Golf / Destination Research

Schedule a Call with Tyler→

Doug Kellogg

Director of Business Development

Hospitality / Attractions

Schedule a Call with Doug→

If you're a current Inntopia customer, contact support directly for the quickest response →

Request Demo

A member of our team will get back to you ASAP to schedule a convenient time.