Katie Barnes

Katie Barnes

Moderate and gradual increases in occupancy, room rate, and revenue have positioned Southeast destination lodging properties on pace for a new, though modest summer record. This positive summary was released yesterday by Inntopia in their DestiMetrics* Monthly Market Briefing to participating destination communities. This month’s analysis includes additional destinations in Virginia, South Carolina, and Florida for a total of nearly 100 properties in nine resort destinations spread across five southeastern states.

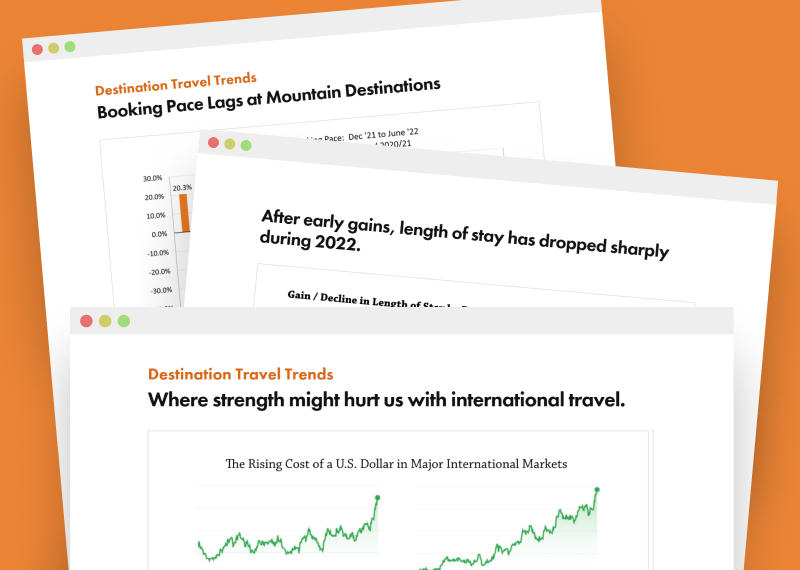

As of July 31, aggregated occupancy for the month of July was up a scant 0.2 percent compared to last July. The Average Daily Rate (ADR) crept up a slight 1.3 percent and combined with the modestly higher occupancy, delivered a 1.5 percent increase in revenue for the month. While still edging up in year-over-year comparisons, it does mark a cooling trend from 30 days ago when July revenues on-the-books were up 5.1 percent in a year-over-year comparison as of June 30.

With one more month to go for the summer, as of July 31, aggregated occupancy for the full summer season from March through August is up 2.4 percent with ADR up a slight 1.3 percent. The slight uptick in both metrics is posting a 3.6 percent gain in revenue for the summer of 2018. It is notable that of the six summer months, only April posted a decline in occupancy.

“Slow but steady gains in occupancy and rate that started in March have mostly held up through the summer months, so if they persist for the next few weeks, this will be a summer record,” reported Tom Foley, vice president of Business Intelligence for Inntopia. “Participating regions benefitted from a quiet storm season and weathered a mid-week Fourth of July holiday with solid numbers, but we are seeing a small amount of slowing in both booking pace and year-over-year gains in room rate. We will be monitoring that closely in the weeks ahead along with economic indicators to see if a cooling trend is developing,” he added.

A look at reservations taken in July for arrival in July through December revealed a 6.3 percent decline in those bookings compared to bookings made in July 2017 for arrivals in the corresponding months last year. Bookings for July, August, and September arrivals were all down compared to last year, ranging from a slight 1.8 percent dip for August, to a dramatic 22.3 percent decline for July. The fall months fared better, with bookings made in July for arrival in October, November, and December all increasing moderately.

Key economic indicators were also summarized in the monthly report. The Dow Jones Industrial Average (DJIA) rose a healthy 4.2 percent and delivered the third increase in the past four months while moving it above the 25,000-point benchmark for the first time since February. A surge in the Gross Domestic Product (GDP) during the second quarter (Q2) of the year was credited with the uptick in the DJIA although a cautionary note suggested that the strength of the GDP was reflecting stockpiling and bulk buying in advance of the U.S. imposition of tariffs on Canadian, European, and Chinese products.

“Most analysts agree that those tariffs will have an impact on earnings, hiring, and consumer prices over the coming months if the tariff disagreements are not resolved during that time,” cautioned Foley. “Analysts also agree that the Q3 GDP in mid-October will be key to determining whether these trade actions have been effective or damaging to the U.S. economy in the short-term.”

The Consumer Confidence Index (CCI) edged up a slight 0.3 percent making it the fourth increase in the past seven months but still indicating a flattening pattern as up and down shifts have been less than 1.4 percent in the past three months.

Employers added 157,000 new jobs in July—well below the 193,000 new positions expected and a considerable cooling in job creation from the previous two months. However, despite the decrease, the national employment rate did drop to 3.9 percent.

“The Southeast is experiencing a modest, but stable, slowing of the booking pace in recent months and that has definitely captured our attention,” Foley continued. “Although this has been a very strong season, the steady occupancy rate throughout the summer is the result of reductions in daily rates, which have been coming down slightly over the past few months. That may be the result of the midweek Fourth holiday or the negative publicity surrounding the red tide in Florida, but since the same pattern is starting to emerge among our nearly 300 western destination properties, it may be more than a fluke and potentially the start of a cooling trend,” he concluded.

Have a question? Just ask.

Tyler Maynard

SVP of Business Development

Ski / Golf / Destination Research

Schedule a Call with Tyler→

Doug Kellogg

Director of Business Development

Hospitality / Attractions

Schedule a Call with Doug→

If you're a current Inntopia customer, contact support directly for the quickest response →

Request Demo

A member of our team will get back to you ASAP to schedule a convenient time.