Destination Travel Trends

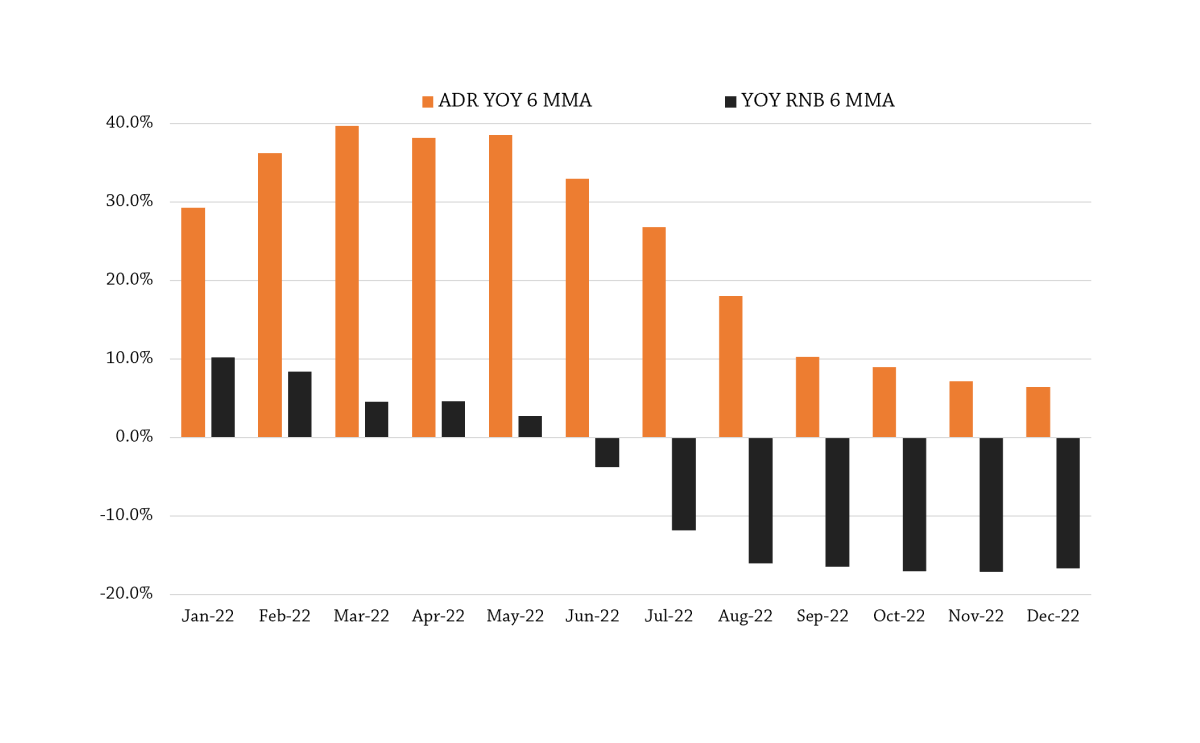

“Travel Inflation” in mountain communities, characterized by extreme year-over-year rate gains, began to soften in 2022. At the same time, booking volume and pace waned and nights booked has been down consistently through the second half of ‘22 and into ‘23.

Why It’s Happening

Consumer’s tolerance for high room rates has waned over the past 12 months as inflation throughout the economy puts pressure on discretionary spending, including travel. The result has been a decline in both booking pace and length of stay, and that means overall fewer room nights being booked.

Do We Care?

In short – absolutely. Higher rates have served mountain lodging providers well in the wake of the pandemic, and not just to ensure positive revenue growth. Staffing issues have made it harder for lodgers to run at capacity, and the higher rate gains have allowed them to operate with fewer guests and remain RevPAR positive.

But rate and room night performance is an ‘either/or’. If one is down, the other must be up by a greater margin than the decline. Room rates in the past several months have not been strong enough to offset the decline in room nights booked, pushing RevPAR to the negative and forcing lodgers into the difficult position of dropping rate further to push nights up, which means finding ways to increase staffing to maintain guest expectations.