Gregg Blanchard

Gregg Blanchard

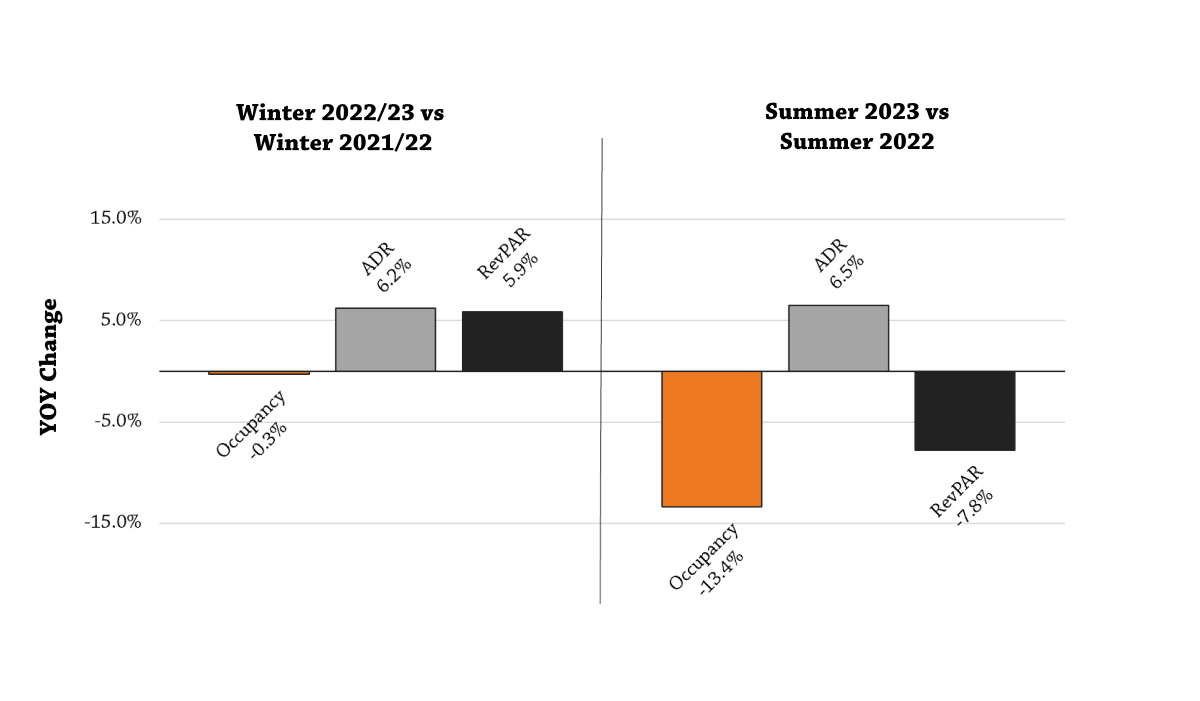

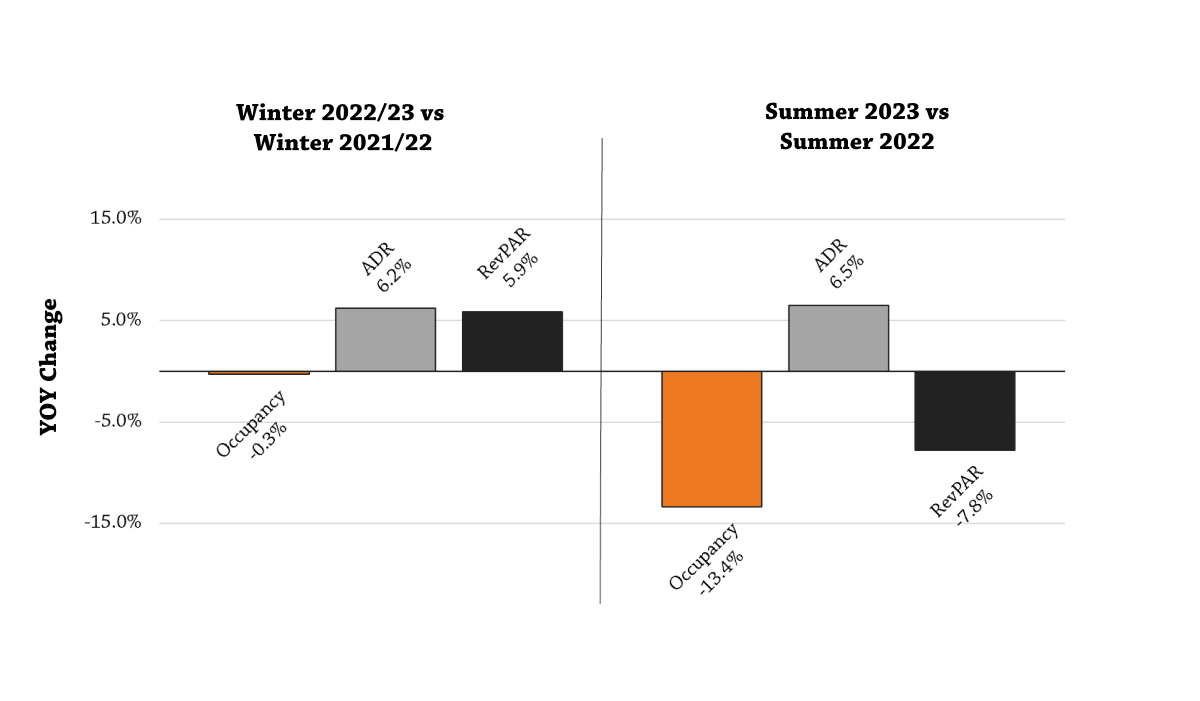

Occupancy, which is almost flat for the winter season, turns sharply negative beginning in May and continues down through September, with Summer currently -13.4% below this same time last year. Meanwhile, rate is holding steady, up 6.5% but no longer able to offset occupancy declines, putting RevPAR – and bottom-line revenue – significantly in the red for the first time since shortly after reopening.

Why It’s Happening

2022/23 winter performance at Western mountain resorts was driven largely by excellent and widespread snow, which – as in the past – has offset economic pressures since early in the season. As the region moves out of winter and into the summer the snow incentive is no longer driving business, but room rates remain up about 40% higher than they were pre-pandemic and 6.5% higher than last year, putting intense pressure on the less-affluent Summer mountain traveler.

Do We Care at This Early Stage?

Absolutely, and for several reasons.

- Occupancy declines are understating how soft visitation is, with actual demand (room nights booked) down -17%, or >111,000 nights, so we’re already well behind.

- Playing catch-up is never good and playing it in an economy that’s not going to be in consumers’ favor for a long while, is even worse.

- Competition from less-expensive options is fierce, with Cruise a great example of a competitor that’s back on it’s feet in 2023 and coming strong.

- Proaction is always better than reaction.

Have a question? Just ask.

Tyler Maynard

SVP of Business Development

Ski / Golf / Destination Research

Schedule a Call with Tyler→

Doug Kellogg

Director of Business Development

Hospitality / Attractions

Schedule a Call with Doug→

If you're a current Inntopia customer, contact support directly for the quickest response →

Request Demo

A member of our team will get back to you ASAP to schedule a convenient time.