Destination Travel Trends

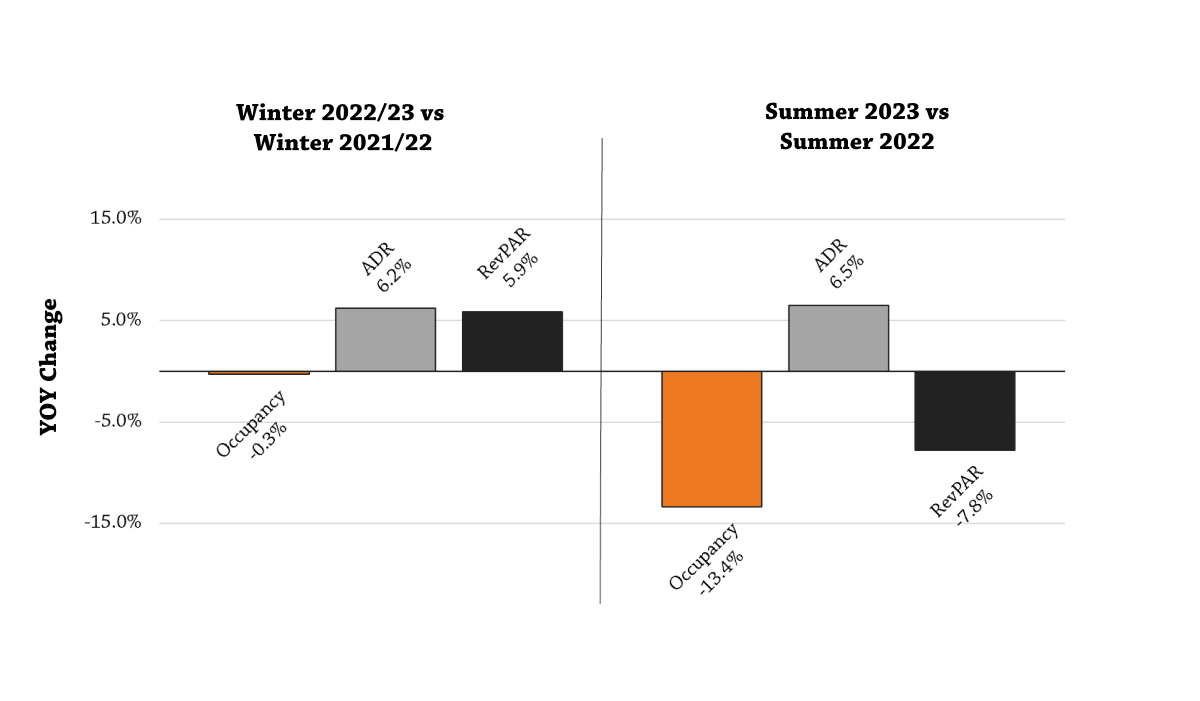

Occupancy, which is almost flat for the winter season, turns sharply negative beginning in May and continues down through September, with Summer currently -13.4% below this same time last year. Meanwhile, rate is holding steady, up 6.5% but no longer able to offset occupancy declines, putting RevPAR – and bottom-line revenue – significantly in the red for the first time since shortly after reopening.

2022/23 winter performance at Western mountain resorts was driven largely by excellent and widespread snow, which – as in the past – has offset economic pressures since early in the season. As the region moves out of winter and into the summer the snow incentive is no longer driving business, but room rates remain up about 40% higher than they were pre-pandemic and 6.5% higher than last year, putting intense pressure on the less-affluent Summer mountain traveler.

Absolutely, and for several reasons.