Trends

We’re providing this narrative as a proactive discussion about the potential impacts of the spreading COVID-19 virus, its economic consequences, and the potential impact on the destination travel industry.

We’re watching the global outbreak of the virus with concern for those whose health is directly impacted, and – more to our expertise – for the potential impact on the destination travel industry. For the past eight weeks we’ve seen no apparent effect on US destination mountain and beach travel, but travel is and will remain at the root of the spread of COVID-19, and the travel industry will be impacted broadly. With 62% of guests traveling to DestiMetrics’ client destinations by air, and 21% of all guests traveling by air internationally, doubtless the mountain and beach sub-categories of destination travel will be impacted. The only questions are for how long and how deeply.

To help answer that question, we’ve conducted a survey of our 300+ property management companies over the past two days (see highlights at the bottom of this document), are digging into our historic data for past events that can guide our thinking, and applying some critical quantitative analysis and expertise to the situation. Our thoughts are below.

As the virus’s global spread accelerated in the last 14 days, economic concern surfaced as investors eyed narrowing or closed supply chains, suppressed travel & consumerism in general, the hard cost of disease containment, and no clear picture of when it will be over. The result was a dramatic drop in global economic markets that, though triggered by fears around COVID-19, exposed long-standing legitimate concerns with economic conditions, setting markets towards a long-overdue correction that’s still playing out in uncertain ways. So, what does it mean to our destination clients?

Normally to answer ‘what it means’ we’d turn to our long data set for prior economic events to which we can make comparisons. The bursting of the dotcom bubble in 2000, the aftermath of September 11 in 2001, and of course the markets leading up to – and coming out of – the 2008 recession. But if we’re honest, none of these events, with the exception of September 11, is a fair comparison. The reason? We’re not talking about solely an economic situation; we’re also talking about a very emotional one for consumers related to personal health for themselves and families. At the core, COVID-19 is causing fear of travel.

And what forms is that fear taking? There’s the fear of getting sick, the fear of being quarantined, the fear of making a travel commitment that’s cancelled for any number of reasons, the fear of a lost investment, and the fear of the unknown. For many this is a scary time with a new pathogen that is not yet medically preventable or fully understood circulating invisibly, making no sound, and carrying no banner. Add sensationalism instead of calm, rumor in place of expertise, and a widespread disregard for scientifically based information in the age of social media and bloggers, and fears among consumers are heightened.

So, now the industry is facing a one-two punch in the travel marketplace, with a new virus causing travel fear, and downward market pressures potentially putting economic strain on consumers.

As a data provider, we’re primarily focused on the effects of current events on the health of the industry and understanding the data in a way that’s meaningful and allows us to provide baseline references for proactive responses to future instances. We provide proactive support, intelligence, and expertise to the marketers and decision-makers that drive consumerism in the marketplace. But we can’t help but wonder about how one approaches addressing this one-two punch, should current conditions worsen.

That in mind and looking proactively toward the end of winter season and ramp-up to summer, we think it isn’t premature to ask industry professionals to ponder how a DMO or a property manager overcomes consumer fears around health while also tackling economic concerns. Is an approach that would resolve the economic concerns of consumers be enough to also offset health concerns? And vice versa? Or must marketers find a two-pronged approach to address both?

And lastly, outside the realm of our expertise is the thought that there may be a moral imperative at some point. Is there a time at which the element of social responsibility of not bringing people together in one place becomes more important to society than driving business? That question is rhetorical until some unforeseen time when epidemic conditions exist within this country, but it’s an interesting one.

Based on how consumers behave and what we’ve seen in the marketplace under other stress conditions, we can suggest some likely performance scenarios, under the assumption that COVID-19 continues to spread as expected, and that the economy will continue to see instability in the mid-term, also as expected.

Guests: International vs Domestic

In the category of “no kidding”, destinations with larger international guest bases, such as those in the Southeast region of the US or the more elite mountain destinations in the West, will likely be impacted more significantly by travel bans or fear of travel than those destinations that rely more heavily on a drive market. This is likely to be true irrespective of whether those destinations’ primary source markets are impacted by incidence of Covid-19 or not. In the end, the further and more confined the travel, the more challenging attracting the guest will be.

Staying Domestic

US travel consumers intending to go abroad this year are more likely to cancel or not book at all and stay domestically if they choose to travel. This will create an opportunity for US destinations to pick up more domestic travelers, partially offsetting international visitation losses.

Drive vs Pure Destinations

This is the domestic version of Staying Domestic above, but in the ‘drive vs pure’ destination context. Domestic drive destinations will get a relative boost over domestic pure destinations, with pure destination consumers shifting to drive markets as they forego long-haul mass transport. While it’s obvious that not all long-haul travelers will shift, what we won’t really know is how many replace their with long-haul travel to short haul / drive travel or if they will cancel completely

Group vs FIT

Properties or destinations that rely heavily on group, conference and corporate bookings are likely to feel the effects sooner and more strongly than those with fewer group stays. Group stays may be subject to cancellation by operators, the buying group itself, or individuals dropping out of the group stay resulting in cancelled rooms. In an early indication, many corporations have already instituted non-essential travel restrictions for staff.

Easier to Cancel…Depending

Properties – and some insurance providers – will be relaxing restrictions around cancellations in an act of goodwill, preferring to rebook or fully refund rather than force payment, in full or part. But as the situation develops, also expect insurance companies to stop covering COVID-19 cancellations booked after a certain date.

Isolation Travel

Properties and property managers with single family units, as opposed to condominium or hotel / motel units, may fare better as travelers look for a more isolated travel experience away from common areas.

Uncrowding

Destinations that rely heavily upon theme parks and other high-volume recreation areas are likely to be more heavily impacted than destinations that rely more heavily on outdoor, non-group activities.

We’ve always urged properties and DMO’s to apply the lessons from historic events to help offset the impact of future events, using the successes and failures of the past. Unfortunately, there are few events in the past that pack the one-two punch we’re talking about should both the virus and the economic issues continue. But, citing economic events in the last 19 years, we can offer the following thoughts.

Value Add

Value add became a positive tool coming out of both 2001 and 2008, most notably the latter, but wasn’t implemented broadly by property managers until the 2011/12 season, and by then knee-jerk rate cuts were deep enough to create the unsustainable revenue models seen at that time. Using value-add mechanisms such as additional nights, free add-ons (tours, tickets, events, meals) is a good way of incentifying guests to travel. Upside: good first step to feel out the consumer before moving on to rate cuts. Downside: often requires 3rd party resources and time to implement.

Rate Leverage

This tool is the most immediately accessible and most visible to the consumer but can be problematic when dramatic action is needed for a sustained period of time. As it stands right now, mountain destinations are up about 3 percent year-over-year for the winter season. Three percent isn’t much to work with, but if properties were to drop rates much, they may fail to offset current flat or declining occupancy rates in many communities, pushing revenue further into negative territory. Upside: Lower rates attract more consumers. Downside: We teach consumers how to treat us. It took until winter 2013/14 for rate to recover to pre-recession levels, fully 4 years after the recession was over. This is the most effective option but a risky one if taken too far and requires a long view of rate recovery.

Rate – the other option

Alternatively, suppliers can look at rate and raise it, or hold it relative to competition, to ensure they’re getting higher quality out of potentially fewer guests. We saw some property managers do this in the aftermath of 2008, but with limited success and usually in conjunction with #4 below. The issues with it in our current environment are twofold: (1) there is rate sensitivity in the marketplace now, and; (2) there is uncertainty about how – or if – this turns into an economic slowing. If Covid-19 is long-sustained and supply chain issues make their way to the marketplace, economic conditions will soften, and consumers will pull back from markets, potentially forcing a race to the bottom on rate for all but the most exclusive or unique offerings. Upside: Hard to find. Downside: Risky.

Changing the calculus – unit closures

In more drastic conditions, where steps to attract visitors are not successful due to economic or health concerns, management of the situation becomes the issue. Closure of units changes some – but not all – of the bottom line for property managers and hoteliers, more effectively the latter. Many properties or property managers simply don’t have or don’t want to use this option. Whether it’s feasible varies by business and property type, and we saw it deployed semi-effectively in 2008/09. The downside is that it can result in workforce cuts and make properties appear vulnerable. Upside: Hard to find. Downside: Limited application. If you’re doing this, things are very bad indeed.

There are undoubtedly revenue managers and marketers in the industry with better and more targeted solutions for the current situation than those modest options noted above. Our job is not to suggest specific solutions, but to point out what the data have told us in the past in hopes of providing guidance as properties and DMO’s make their decisions around dealing with Covid-19 and any ensuing long-term economic consequences.

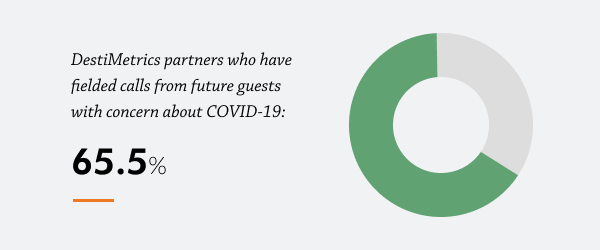

DestiMetrics conducted a broad survey of our destination travel clients and destinations on March 3. The survey is still ongoing, but a broad response has been received, further supporting the industry’s focus on this issue. Here are some of the key findings to-date.

Of the respondents:

This will very likely be a long-term event, given the potential impact on global economies and consumer travel confidence. Making sure the industry is prepared, even at this early stage, to make decisions based on scientific fact rather than fiction or rumor, ensuring we don’t repeat expensive mistakes from the past, and being proactive rather than reactive are all things that we can do to minimize disruption and duration in the domestic destination travel market. Inntopia will continue to update our clients and the industry as we monitor the situation in the weeks and months ahead.