Stacey Mullen

Stacey Mullen

Feb 14, 2024

The economy might be going like gangbusters this winter but Mother Nature is not–and the considerable power of snowfall, or lack of it, is apparent this season at many ski resorts. As daily rates have remained remarkably high, bookings retreated further than they have for more than two years. According to the monthly Market Briefing released yesterday by DestiMetrics,* the Business Intelligence division of Inntopia, the optimism for a strong January waned as patchy snowfall coupled with high daily rates combined to deter some overnight visitors—despite economic indicators and consumer confidence that continues to rise.

Downhill slide for January

Actual occupancy for January in a year-over-year comparison was down 6.3 percent while the Average Daily Rate (ADR) was up 3.4 percent, resulting in aggregated revenues that were down 3.1 percent. When drawing the same comparisons with the winter season of 2019-20 and the last typical season prior to the pandemic, occupancy this January was down 1.1 percent while ADR was up an impressive 38 percent compared to four years ago.

Winter season currently in slow skid

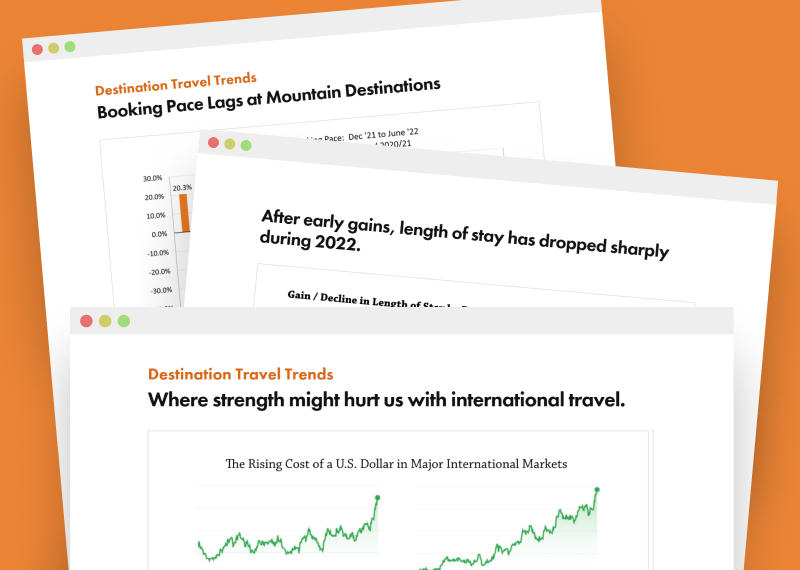

For the fifth time in six months, the booking pace, which measures the number of bookings made for arrival in the next six months, declined. The 18.9 percent plunge in bookings for arrivals in January through June is the steepest decline recorded since June 2020 when anxiety about the pandemic was near its height. “Snowfall is certainly a major factor in this drop but the fact we’ve seen the booking pace steadily dropping in recent months–before snow was an issue–strongly suggests that price sensitivity is also playing a part,” said Foley, senior vice president of Business Intelligence for Inntopia.

Because of that declining pace, occupancy for the full winter season from November through April as of Jan. 31 is down 5.9 percent compared to last year at this time with declines in all six months. The declines range from a 2.7 percent dip in December to a sharp 7.9 percent drop for April with the months of January through March all down more than six percent compared to last year at this time. Partially offsetting those occupancy losses are daily rates that remain above last year in all months except December and April which are down slightly but March is posting a healthy 7.8 percent increase in ADR while February is also looking strong—up 4.4 percent. But rate strength can’t fully compensate for the lower occupancy and revenues for the season are down 2.9 percent from one year ago at this time.

This winter does stack up favorably to four winters ago. Occupancy this winter, even with often marginal snow conditions, is only down 1.4 percent compared to that season at this time, while daily rates are up a strong 41.2 percent and are delivering properties with revenues that are 39.3 percent higher than the winter of 2019-20.

“As we’ve seen over and over again, snowfall plays the single most crucial role in how a winter season plays out and for the first time in a number of years, we are really seeing the impact from skimpy snowfall,” offered Foley. “The unusual aspect about this year though is this mixed scenario with the slowest booking pace we’ve seen since 2020 and yet the strongest room rates ever recorded.”

Economic indicators and optimism keep going up

Although not as dramatic as December’s rise, the Dow Jones Industrial Average (DJIA) once again continued its upward trajectory by gaining another 1.2 percent to close over 38,150 points and making it the second consecutive monthly high for the index and posting an all-time high on Jan. 30. The increase was attributed to good economic data including positive job growth that suggest a soft landing from the prolonged inflation situation.

“When Wall Street is looking this bullish, that can have a significant influence on how, when, and on what consumers will spend their dollars on, and higher markets typically point to increased discretionary spending on travel,” noted Foley.

And once again, the Consumer Confidence Index (CCI) and the Consumer Sentiment Index (CSI) from the University of Michigan both rose sharply in January. The CCI was up 6.3 percent and finished the month with its strongest reading since December 2021. Consumers reported feeling upbeat about current conditions, the short-term outlook for the job market, and falling inflation. The prospect for lowering interest rates in the near future also fueled optimism. The growth was reported in all age groups with the 55 and older crowd showing the biggest jump in confidence.

The CSI experienced a bigger surge, jumping 13.3 percent and marking the fifth largest increase since the establishment of the Index in 1978. Improving labor and earnings along with potential for declining interest rates were also cited as reasons for the markedly improved outlook.

For the third consecutive month, the National Unemployment Rate remained unchanged at 3.7 percent although employers significantly exceeded expectations by adding another 353,000 new jobs. When combined with the upward adjustment of 100,000 addition jobs for December, the tally for 2023 was approximately 3.1 million new jobs. “Unemployment has been below four percent for two years and along with market strength, suggests the economy is well positioned for a soft landing. But strong jobs can also be problematic if you are waiting for interest rates to come down—especially after this month’s inflation report,” observed Foley.

The National Inflation Rate dropped back down to 3.1 percent in January, higher than the projected 2.9 percent. Core inflation, with energy and food taken out of the equation, was 3.9 percent and well above targets. “Of greater concern is the 0.3 percent increase in prices between December and January that were partially supported by wage growth and hiring,” clarified Foley. “Some policy makers at the Federal Reserve Bank have suggested that continuing price increases will likely delay interest rate cuts until at least the third quarter. This will make discretionary spending using credit more expensive for travelers, potentially extending the current price sensitivity,” he continued.

Keeping an eye on

*Snowfall: While the Northeast is experiencing a generally good snow year, the western U.S. has been considerably less fortunate with snowstorms appearing only intermittently and warmer than usual temperatures taking a bite out of slope conditions in some locations. Conditions, with the aid of snowmaking, have been adequate but are not inspiring overnight visitors to book, especially with record-high rates still in effect in most places.

*Winter occupancy: For the sixth consecutive month, occupancy for the winter season took another step back in January—going from a deficit of 3.5 percent at the end of December to a seasonal deficit of 5.9 percent as of Jan. 31. Performance was weaker than expected for both the first week of the month and the Martin Luther King, Jr. holiday weekend. The decline translates into 21,600 fewer room nights occupied in January compared to one year ago among participating properties.

*Average Daily Rate (ADR): Reduced rates are currently not being used as an incentive to attract customers and despite the snow challenges, as of Jan. 31, the aggregated daily rates for the winter season are up 3.2 percent—up from 2.4 percent at the end of December. A sharp increase in the ADR for March bookings was credited for the increase which rose 3.8 percent in the last 30 days for March arrivals as all other months are seeing scant declines.

“Following a disappointing December, hopes were high for a strong January with this year’s late school holiday breaks offering an opportunity to capture a strong post-holiday crowd, and snow in the first 10 days of the month boosted that optimism,” explained Foley. “But while there was a bump during that first week, the MLK weekend fizzled with the absence of big, newsworthy snowstorms in the West and as a result, the booking pace that has been cooling off for several months took an even bigger hit during January,” he continued. “But economic pressure on consumers is slowly easing and if a few strong snowstorms move across the western region in the coming weeks, there is a possibility that the winter season can at least partially be turned around, particularly in March with both Spring Break and the Easter holiday breaks landing at the end of March this year.

Have a question? Just ask.

Tyler Maynard

SVP of Business Development

Ski / Golf / Destination Research

Schedule a Call with Tyler→

Doug Kellogg

Director of Business Development

Hospitality / Attractions

Schedule a Call with Doug→

If you're a current Inntopia customer, contact support directly for the quickest response →

Request Demo

A member of our team will get back to you ASAP to schedule a convenient time.