Katie Barnes

Katie Barnes

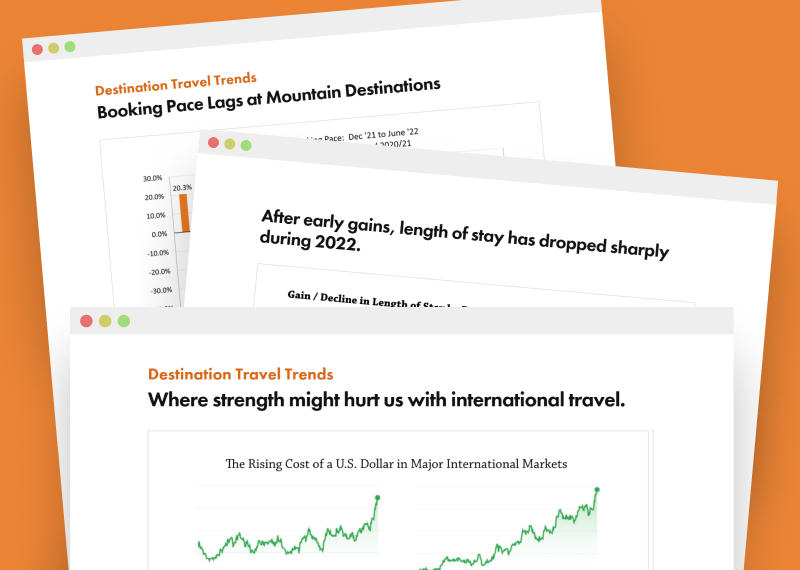

The pent-up demand for resort vacations in Florida, Georgia, and South Carolina that led to a flood of new summer bookings during May and June, slowed down during July as initial demand was met and an alarming resurgence of Covid-19 cases throughout the region triggered a cool down of the hot booking pace of the previous two months. DestiMetrics, a division of Vermont-based Inntopia,* released their most recent assessment of booking trends yesterday and revealed a slowing in new reservations among participating resorts. The monthly Market Briefing included data collected from five Southeast resort destinations with details on occupancy, daily rates, and revenue through July 31.

The year-over-year plunge in bookings during July for arrivals in the next six months illustrates a striking reversal from May and June patterns. Bookings were down 40.2 percent compared to last July for arrivals in the same period. All six months experienced a decline with July taking the biggest hit—down 66.3 percent. This is the first time since April that there has been a decline in the booking pace.

Despite the drop in bookings, there was some good news for participating properties. Actual aggregated occupancy for the month of July was down a modest 2.9 percent compared to July 2019 but the Average Daily Rate (ADR) for the month rose a robust 10 percent compared to last July and delivered a strong year-over-year gain in revenue of 6.8 percent for the month.

“Despite another month of widespread regional openings at lodging properties and strong rate growth, lodging performance in the Southeast softened during July compared to the booming reports in May and June,” reported Tom Foley, senior vice president for Business Operations and Analytics for Inntopia. “The dynamics of this summer season have been extraordinary in the past four months since the pandemic was declared. We have seen a dizzying shift in activity as the region emerged from catastrophically low occupancy in the early part of summer driven by a record-breaking booking pace in May and June. And now, as the summer winds down, demand is waning, and concern about rising Covid-19 cases is once again changing the narrative,” he added.

Economic measurements

For the fourth consecutive month, the Dow Jones Industrial Average (DJIA) increased and was up 2.8 percent compared to last month but remains two percent lower than last year at this time. After two months of moderate increases, the Consumer Confidence Index (CCI) once again lost traction and dropped 5.7 points and as of July 31 is a dramatic 31.8 percent lower than it was in July 2019. The national Unemployment Rate dropped to 10.2 percent (from 11.1 percent in June) as employers exceeded analysts’ expectations and added 1.8 million jobs during the month.

“While Wall Street is showing considerable optimism about the eventual recovery from the pandemic, the DJIA increasingly fails to reflect the reality of conditions for the average consumer,” cautioned Foley. “Consumer confidence is unsteady, 30 million people remain unemployed, and government relief programs have expired and talks for extending financial support have stalled in Congress.”

Looking Ahead to Fall and Winter

While there has been some recovery in occupancy for arrivals in the months of September through February 2021, as of July 31, occupancy is down 17.2 percent for those months compared to the same time last year. Conversely, ADR is up a strong 9.8 percent for the winter season but despite the increase in rates, the notable decline in occupancy is not enough to offset the higher rates so revenue for the season is currently down 9.1 percent.

“The Southeast has weathered the Covid-19 storm relatively well for the past few months compared to other regions as properties rapidly reopened to meet surging demand,” noted Foley. “At the same time, strong increases in daily rates in the past few months will help cushion the blow from the deep revenue losses suffered during the nearly two months of closures but it will still be a significant decline for many. As we move into the winter season, it is clear that the many health, economic, and societal issues surrounding the pandemic will continue to be the driving force in business operations in the months ahead,” Foley concluded.

*DestiMetrics, part of the Business Intelligence platform for Stowe-based Inntopia, tracks resort performance in selected mountain and southeast U.S. destinations. They compile forward-looking reservation data each month and provide individualized and aggregated results to subscribers at participating resorts. Data from the Southeast is derived from five resort destinations in three states including South Carolina, Georgia, and Florida.

Have a question? Just ask.

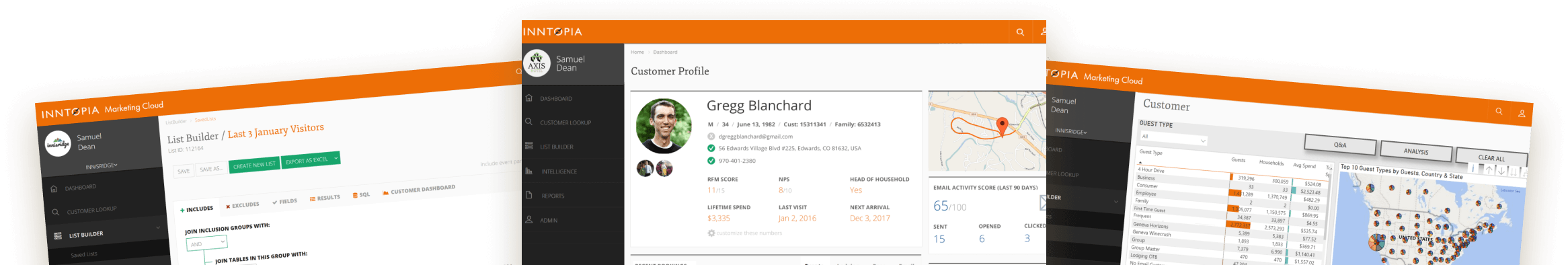

Tyler Maynard

SVP of Business Development

Ski / Golf / Destination Research

Schedule a Call with Tyler→

Doug Kellogg

Director of Business Development

Hospitality / Attractions

Schedule a Call with Doug→

If you're a current Inntopia customer, contact support directly for the quickest response →

Request Demo

A member of our team will get back to you ASAP to schedule a convenient time.