Stacey Mullen

Stacey Mullen

Summer occupancy is likely to be down compared to both last summer and the pre-pandemic, benchmark-setting summer of 2019—but the Average Daily Rate (ADR) has continued to soar, allowing lodging properties to offset the lower occupancy figures and assure an increase in aggregated revenues compared to both those summer seasons.

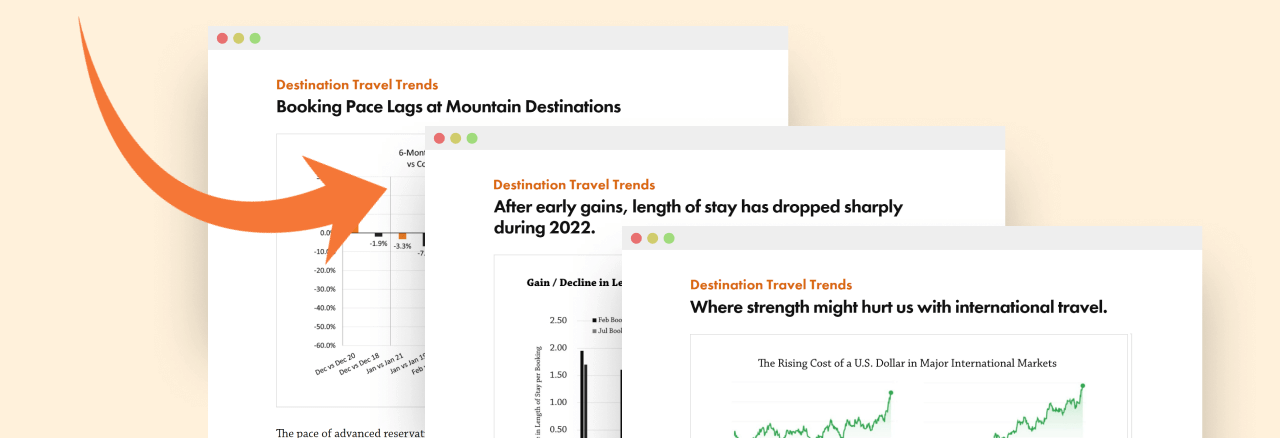

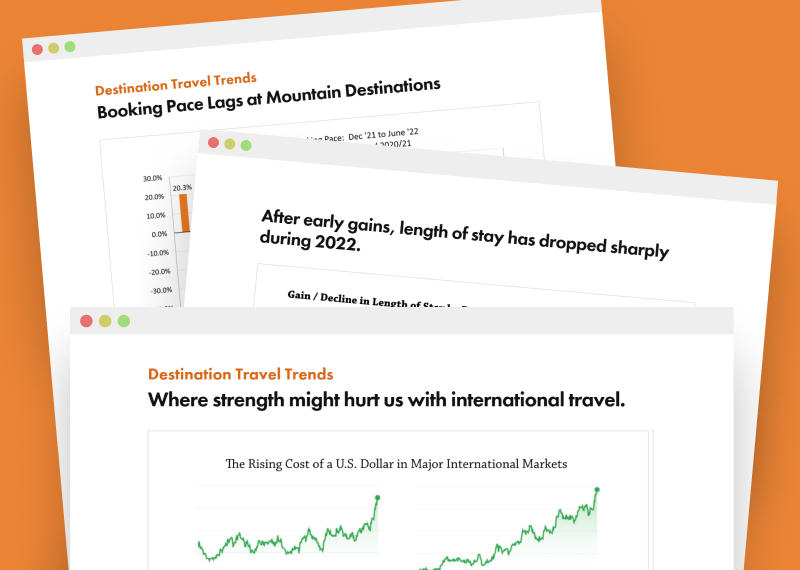

According to DestiMetrics,* part of the Business Intelligence division of Inntopia, in their most recently released monthly briefing, the booking pace during the month of September for arrivals in September through March was down 5.7 percent in a year-over-year comparison and marks a return to the consistently declining booking pace over the previous eight months with the exception of August. Although booking pace has slowed slightly, the data also revealed that while guests are making fewer reservations, they are staying longer, and with sustained high rates, a solid foundation for the winter season is being established. Results are compiled from data through Sept. 30 from 17 western mountain destinations in seven states.

September was up

Compared to last year, actual occupancy for the month of September was up 4.9 percent and when coupled with a 5.3 percent increase in ADR, delivered a 10.4 percent increase in aggregated revenue. In contrast to two years ago when COVID-19 was still raging, occupancy is up 22.7 percent, rates are up 25.7 percent, and revenues are up 54.2 percent. When compared to the pre-pandemic September of 2019, occupancy finished up 1.4 percent and daily rates were up an impressive 44 percent to provide lodging properties with a 46 percent increase in revenues.

Summer is almost a wrap

Looking at the full summer season from May through October, as of Sept. 30 with five months already completed and just one month to go, occupancy is down five percent compared to last summer with declines being posted in every month except September and with August posting the steepest drop—down 11.4 percent. ADR is up 4.6 percent with increases in all six months but with lower occupancy, aggregated summer revenues are down a scant 0.6 percent compared to last year. When compared to two summers ago, the summer pattern mimics the September results, with occupancy up 43.3 percent for the full summer, rates up 27.4 percent, and revenues showing a whopping 82.6 percent increase. But when compared to the pre-pandemic but record-setting summer of 2019, occupancy is down 5.6 percent while ADR is up a striking 38.8 percent. Those very strong rates are offsetting the declines in occupancy to provide a 31.1 percent gain in revenue compared to three years ago.

“Performance for the summer season was only lightly impacted by September’s relatively small share of the season’s booking activity, with summer occupancy levels compared to both 2021 and 2019 barely changing from one month ago,” offered Tom Foley, senior vice president of Business Intelligence for Inntopia. “The same is true for daily rates which held, while the booking pace, which had enjoyed an uptick last month after seven months of slowing, once again slipped below year-over-year comparisons.”

Winter coming into focus

As of Sept. 30, on-the-books occupancy for the upcoming winter season from November through March is down 2.4 percent compared to this time last year with decreases in two of the five months—November is down 9.6 percent and December is down 20.1 percent. However, the ADR for those months is up 14.1 percent compared to last year with increases in all five months. That rate strength is helping to offset the loss in occupancy to deliver a healthy 11.8 increase in aggregated revenues over one year ago.

In sharp contrast to two years ago when resorts were struggling to formulate and announce dramatic changes in daily operations, occupancy is up 70.3 percent and ADR is up 43.7 percent for a stunning 144.8 percent increase in revenues compared to the uncertain start of the 2020-21 season. A truer “apples-to-apples” comparison can be made to the pre-pandemic booking period three years ago at this time for the 2019-20 winter season with occupancy as of Sept. 30 up a solid 8.1 percent, ADR up a robust 38.8 percent, and revenues up a remarkable 49.5 percent.

Economic indicators

Investors experienced their toughest month since October 2020 as the Dow Jones Industrial Average (DJIA) plunged 9.6 percent or more than 3,053 points during September to finish the month below 30,000 points for the first time since November 2020. The dramatic drop was attributed to persistently high inflation and growing worries about a possible recession along with forecasts for a decline in the Gross Domestic Product (GDP). The striking sell-off during the month has left the DJIA 15.1 percent lower than September 2021.

“It’s been a Catch-22 situation as the concerns about inflation that drove markets down earlier this year have now been replaced by the efforts of the Federal Reserve to curb inflation by steadily raising interest rates,” explained Foley. “Both scenarios have rattled financial markets since decreases in various indexes can slow employment growth, weaken consumer confidence, and even push more affluent consumers to the sidelines.”

In contrast with market declines, the Consumer Confidence Index (CCI) rose in September for the second consecutive month by adding 4.2 percent and reaching its highest level since last April. Although up slightly due to easing gas prices, strong job numbers, and higher wages, it is down 1.6 percent in comparison to last year at this time.

The national Unemployment Rate decreased from 3.7 to 3.5 percent during September while the pace of job growth slowed as employers added 263,000 new positions and wages remained unchanged from last month. The Leisure and Hospitality sector led the way in job creation with 83,000 new positions—primarily in food services. However, it still remains down 1.1 million jobs from before the pandemic.

The National Inflation Rate at 8.3 percent in September remains unusually high but as cooler weather gets closer, declines in both natural gas and other fuel prices is important for consumers. However, with the Federal Reserve Bank raising interest rates by 0.75 points on Sept. 21 in an effort to combat inflation, there has been a cooling of some economic activity such as home purchases and credit related purchases.

Keeping an eye on

*Length of Stay: The average stay for bookings made in 2022 is down moderately following the pent-up demand and booking surge in 2021 but still remains up sharply compared to the pre-pandemic 2019 winter—with the average stay up 0.39 nights compared to that season.

*Arrival Day of Week: The day of week for arrivals shifted considerably at the beginning of pandemic, with bookings for Saturday arrivals dropping from 19 percent of all bookings to just 13.2 percent in 2020. At the same time, bookings for midweek arrivals ticked up, led by Thursday arrivals which jumped from 13.4 percent to 17.1 percent in 2020—driven by visitors trying to avoid crowds and the flexibility of work-from-home schedules for some workers. Those trends are starting to shift back to a more typical pattern with Friday still the busiest day of the week for arrivals but a more even distribution of arrival dates compared to before the pandemic.

*Booking Lead Times: the amount of time between when a booking is made and a guest arrives has extended by about 10 days compared to pre-pandemic patterns. Lead-times are expected to remain extended for now.

“Summer will likely finish with a modest decline in occupancy but with such consistently strong daily rates, most lodging properties will still be enjoying higher revenues than last summer,” remarked Foley. “Of course, with the leaves starting to turn and the first dusting of mountaintop snow in many locations, the focus is turning to winter. At this point as bookings begin to really ramp up, we are seeing some softening in November and December, primarily due to a shift in holiday school breaks,” he explained. “But what will really impact the coming season as the pandemic fades away, is the all-important amount of snowfall and the direction of economic indicators—driven by inflation, interest rates, and financial markets,” he concluded.

Have a question? Just ask.

Tyler Maynard

SVP of Business Development

Ski / Golf / Destination Research

Schedule a Call with Tyler→

Doug Kellogg

Director of Business Development

Hospitality / Attractions

Schedule a Call with Doug→

If you're a current Inntopia customer, contact support directly for the quickest response →

Request Demo

A member of our team will get back to you ASAP to schedule a convenient time.