Trends

The booking pace picked up during September for the last two months of the summer and it looks pretty likely that the summer of 2017 will set the seventh consecutive occupancy record.

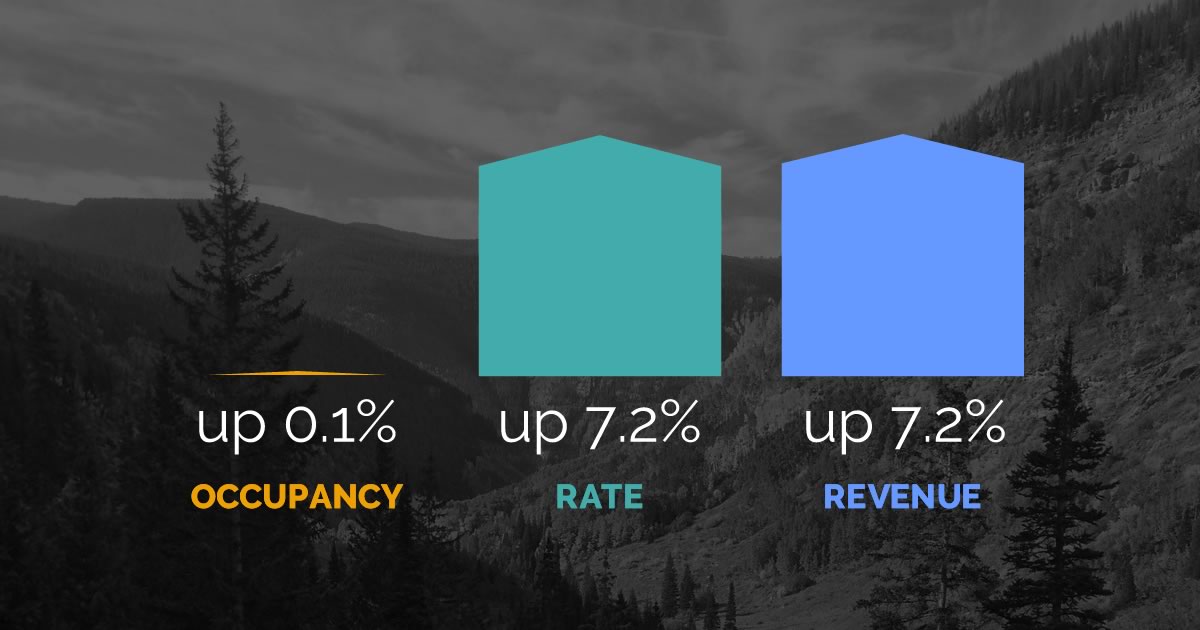

Overall occupancy at western mountain destinations for the six summer months encompassing April through October were buoyed up by bookings made in September for arrivals in September and October. With the uptick in bookings during September, as of Sept. 30, aggregated summer occupancy edged up 0.1 percent while revenues are up a robust 7.2 percent compared to the same time last year. Inntopia released the results in their monthly DestiMetrics Market Briefing that also announced a reversal from last month’s report when overall summer occupancy figures were dipping for the first time in six years. For the month of September alone, occupancy was up 1.4 percent with a 7.3 percent increase in revenue.

“Summer occupancy recovered in September driven by strong bookings and the net result is that a summer season that seemed likely to miss a seventh consecutive occupancy record is now almost certainly going to finish with a positive gain thanks to October growth,” assured Tom Foley vice president of Business Intelligence for Inntopia. “Although the increase in occupancy is very slight with gains in May, September, and October and declines in June, July and August, the Average Daily Rate (ADR) continued to increase resulting in revenue increases for all six months.”

The Briefing also provided updated information on the status of winter bookings. As of Sept. 30, aggregated winter occupancy for November through March is down a slight 1.1 percent compared to the same time last year. There is currently no data available for April. ADR is up five percent for the winter with increases in every month except November leading to an aggregated increase in revenue of 4.1 percent.

“The trend of nearly flat occupancy and year-over-year increases in rate that emerged last winter and carried through the summer appears to be continuing into the upcoming winter,” observed Foley. “Lodging properties are pursuing their revenue goals with rate increases with the expectation that higher rates will offset lower occupancy figures. In an industry that depends on new visitation and growth for long-term sustainability, it will be interesting to monitor the effectiveness of this strategy but it is certainly working for them in this robust economy,” Foley continued.

Economic indicators remained strong and stable for the month of September, an oft-cited explanation for tolerance of rising rates. The Dow Jones Industrial Average surged up 2.1 percent in September for the fourth consecutive all-time monthly close—despite record setting damage from storms in late August and September. The Dow is up 22.4 percent compared to the same time last year. The market resilience is showing up with the sustained high values for the Consumer Confidence Index thought it slipped very slightly to 119 points for an 0.5 percent decrease in September. While confidence remained strong nationally, it decreased sharply in Texas and Florida in the wake of the hurricanes as consumers began the clean up and rebuilding process. Job creation declined in September for the first time since September 2010 due almost exclusively to the loss of 133,000 jobs in the services industry in the wake of both hurricanes. Despite the loss in jobs, the Unemployment Rate dropped from 4.3 to 4.2 percent but the decline was attributed primarily to the unemployed no longer looking for work.

“Despite the huge impact of hurricanes on several U.S. regions this autumn, consumer’s assessment of current conditions remains favorable and their expectations are that the economy will continue to grow for the short-term,” reported Foley. “Economic stability and consumer confidence has served the mountain destinations very well for the past several years and preliminary indicators of the coming winter suggest the trend will continue for the foreseeable future,” concluded Foley.