Trends

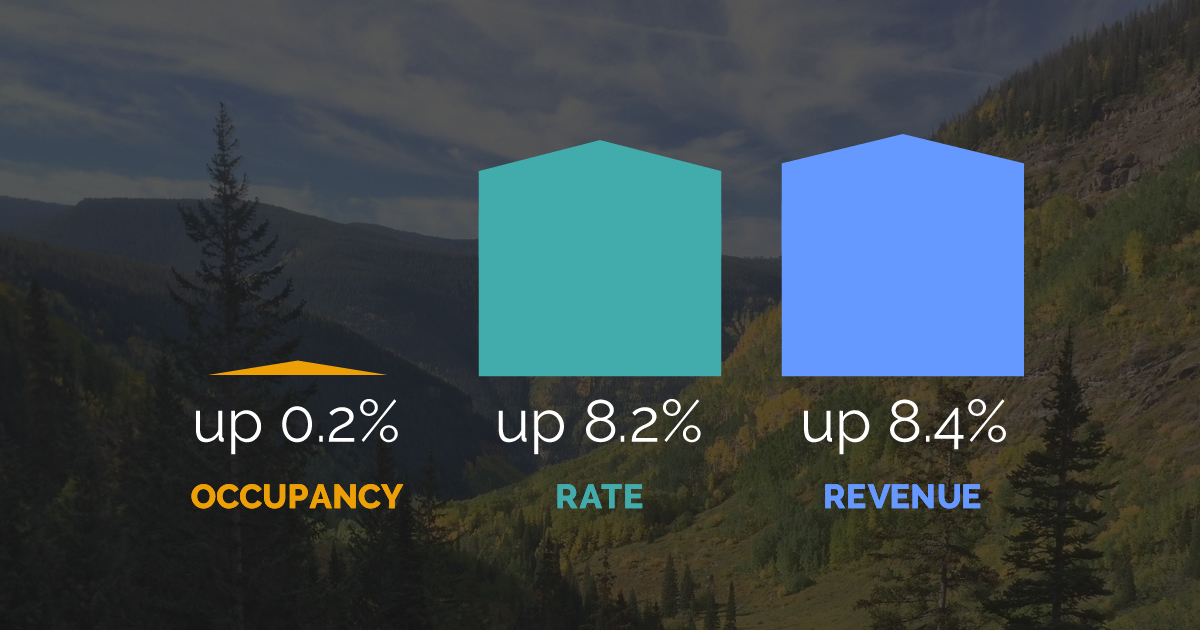

Even though summer occupancy among western mountain resort destinations is up only a scant 0.2 percent compared to last summer (May through October), revenues continue to gallop ahead driven by robust gains in the Average Daily Rate (ADR). As of June 30, aggregated revenues are up 8.4 percent according to the most recent data released by Inntopia in their monthly DestiMetrics* Market Briefing. For the month of June, occupancy dipped 0.5 percent but rate increases led to a 6.5 percent boost in revenues.

This recent data suggests that there will be a sixth consecutive revenue record this summer, supported by strong market conditions although a new record for occupancy is less certain. Looking forward, occupancy in every month except October remains essentially flat with variances of less than two percent while October occupancy is currently up 8.6 percent compared to the same time last year.

“A booming economy has allowed lodging properties to nudge rates up for the past year, but occupancy is lagging which is unusual and in contrast to previous summer seasons,” explained Ralf Garrison, director of DestiMetrics. “One or more culprits could be contributing to this trend including rate resistance, lower demand, or fewer available rooms during peak weekends and periods,” he added.

The trend of flat occupancy and increasing revenues is appearing in the data for both the Far West and the Rocky Mountain regions. Aggregated results for the Far West resorts in California, Nevada, and Oregon are hovering at a slight 0.2 increase in occupancy with revenues up 6.1 percent. Ditto for the Rocky destinations in Colorado, Utah, Idaho, Montana, and Wyoming where occupancy for the summer is up a scant 0.6 percent, but revenues are up a healthy 9.0 percent.

“While this pattern works well for the bottom line, when we see a trend like this persist, there is concern that the lower income segment of our customer base may be getting forced out of the market by the steady rate increases,” explained Tom Foley, director of Business Intelligence for Inntopia.”

Ongoing tracking of key economic indicators summarized in the Briefing continue to remain generally positive. The Dow Jones Industrial Average rose another 341 points for a 1.6 percent gain in June while the Consumer Confidence Index ticked up a slight 1.1 percent after slipping down in April and May. Employers exceeded expectations with the addition of 222,000 new jobs as well as revised upward job creation figures for April and May—33,000 in April and 14,000 in May. However, as job seekers returned to the employment market, the Unemployment Rate ticked up to 4.4 percent. The Briefing also emphasized that while employee earnings were up 2.5 percent compared to the same time last year, the pace of earnings remains well below overall economic growth.

“Financial markets are still waiting for the impact of legislative action, or inaction, in Washington to determine the economic direction for the remainder of 2017,” cautioned Foley. “A ‘wait and see’ attitude is still in evidence in the wider marketplace, but for now, the bottom line at mountain destinations this summer is looking great.”